Many are seeing the low VIX as a warning sign of too much complacency, and I totally get that. Protection is hardly ever this cheap and I would always advocate buying some here as ‘just in case’ insurance.

Last year all it took was some rumblings in the Middle East and then Greece to stir up the pot and get everyone worried. Remember, we don’t go out and buy fire insurance on our house when the neighbor’s roof is on fire.

So, for the most part volatility has been coming in since late December and has stayed down. That doesn’t settle right with some, who are looking for big movement in order to make money. Being an options player what matters to me is momentum and trend in the shorter term. So, while a very low 1/2% range may be difficult for some to trade it is fine by me. Will that last? Of course not.

The market will tell us when a change in trend is evident.

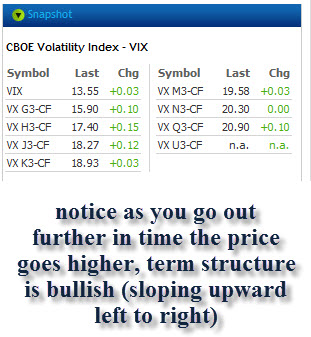

The main focus should be on the VIX futures, which portray a still bullish term structure (each month rising as you go out further, see above.)