Nuverra Environmental Solutions (NES), a provider of environmental solutions to customers in the energy and industrial end-markets, shares have declined over 59% since the beginning of 2013. The stock currently trades at price/sales ratio of 0.73x and has an average analyst price target of $22.50. On Monday, March 10th, Nuverra will report Q4 earnings after bell. Over the past five quarters the stock has moved higher on three of those reports.

Unusual Options Activity

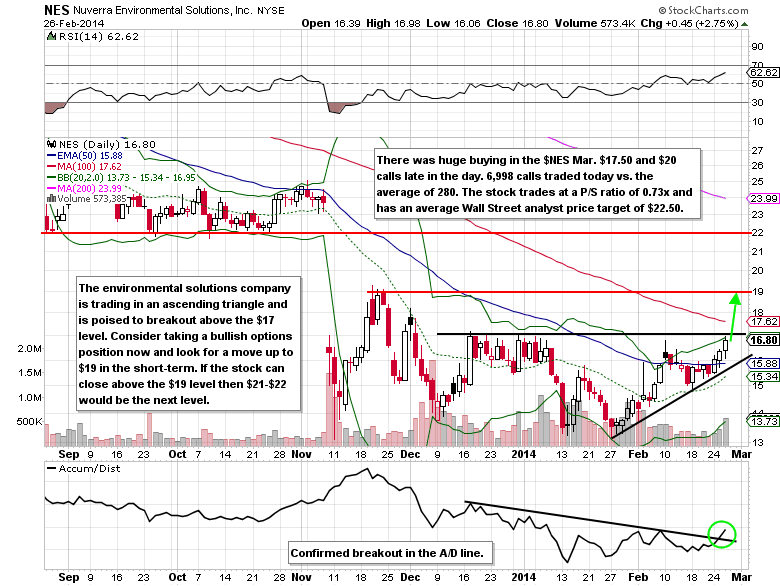

Towards the end of the day on Wednesday, February, 26th, large call buying showed up in the Mar $17.50 and $20 calls. The largest individual trade was a buyer of 2,300 (the right to buy 230k shares of stock) Mar $20 calls for $0.40 each. On average, Nuverra only trades 500k shares of stock per day. 6,998 total calls traded vs. the daily average of just 280 calls. The call to put ratio finished at 64:1.

Technical Analysis

Shares of Nuverra have been trading in an ascending triangle over the past couple of months and are now poised to breakout above the $17 resistance level. If/when the stock can close above $17, the next level would be $19 and from there major resistance wouldn’t set in until $22.

Nuverra Environmental Solutions Options Trade

Buy the Mar $17.50 call for $1.35 or better

Stop loss- None

1st upside target- $2.50

2nd upside target- $4.50

Disclosure: I’m long the Mar $17.50 calls for $1.30 each.

= = =