|

| Texas Instruments acquisition of National Semiconductor has provided a major boost to the entire sector. |

US stock futures point to a lower open, a rare sighting over the past few weeks as the market has rebounded back to near multi-year highs. Panic and fear gripped the market as fears of a nuclear holocaust grew during the post-earthquake crisis in Japan, but those fears subsided and investors began to aggressively buy the long-awaited pull-back. Friday the S&P met resistance at the top of the previous wedge pattern, and could not break through that level again yesterday. Today’s slight pre-market pullback appears to be simply healthy digestion during this rally that will work off some of the overbought condition of this market.

We are set to open right about at Friday’s low, so it will be interesting to see whether we can hold this two-day range. If we can rally off the open, the move to highs will come sooner rather than later. As far as headlines go, after the close yesterday Texas Instruments Inc. (TXN) announced it would buy National Semiconductor Corporation (NSM) for $6.5 billion in cash, or $25 share, a 73% premium on the stock. The acquisition has boosted the entire semiconductor sector this morning due to the high premium paid by Texas Instruments. Apple Inc. (AAPL) is down around 1.5% after its weighting was cut during the rebalancing in the Nasdaq 100, forcing some to sell the company’s stock. AAPL was down more than 3.5% at one point this morning but has recovered.

For more market and stock commentary watch the T3Live.com Morning Call with Scott Redler and Alix Steel below.

While the market has been strong over the past three weeks, there have been stocks and sectors that have been even stronger over that period. We have been a big believer in the fertilizer group, and sector has bounced hard since bottoming during the Japan mess. Leader PotashCorp./Saskatchewan (POT) has bounced more than 22%. Chinese Internet stocks Sohu.com, Inc. (SOHU), which has gained more than 17% in the last five trading days, and SINA Corporation (SINA), which has gained nearly 36% in the past 12 trading days, have led the market. Yesterday was perhaps a day to take some incremental profits as the market was once again unable to break through resistance.

There are two frames of mind to get into when the market comes into some weakness. If you have more a long-term investors perspective, this can be a time to start adding to positions in strong stocks. The fertilizers still have some room to the highs, and have a compelling long-term fundamental story due to increasing demand for food due to the rise in population and affluence around the world. Tech, commodity, and mining stocks have been strong, so this pullback could be an opportunity to add in those areas for the next leg higher.

Freeport-McMoRan Copper & Gold Inc. (FCX) has held up well and is setting up another buy around $56-56.50.

Exxon Mobil Corporation (XOM) has also consolidated nicely and has set up another trigger buy at $85.

However, the more active trader may also look to balance out his portfolio at this stage with some strategic shorts of stocks that have been weak. At the head of that list has to be Research in Motion Limited (RIMM), which broke down through its key support level yesterday. Research in Motion’s Blackberry has been beaten down by Apple’s iPhone and the lineup if Android-powered smartphones, and the chart has an equally gloomy outlook after a poor earnings quarter. You can likely expect some continuation to the downside in RIMM if the market sustains any weakness, and it would be a good area to balance some longs.

Heavy Clouds

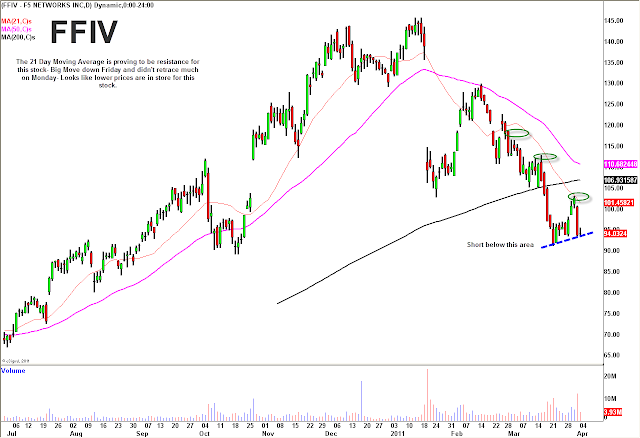

Also there are a few stocks that have been weak that are still above key levels and might provide a little more momentum to the downside if the market sells off during the session. The cloud computing sector has been in the doghouse this year, especially F5 Networks, Inc. (FFIV), which tried to fill its earnings gap from January but was unable to before breaking down below that level. The stock again tried to bounce last week but pulled in hard Friday and was unable to take back much of that down move yesterday. Watch FFIV on a break below $93.40 and then lows of $91.10 if it gets there.

Optical Networking Weak

Another sector that has come under fire has been the optical networking space. The sector had been hot leading up to the earnings report from Finisar Corporation (FNSR), but weak numbers sent the entire sector plummeting. Some traders have tried to catch a bounce in JDS Uniphase Corporation (JDSU), thinking it could have been punished too harshly, but the stock has remained out of favor. A break the $18.52 pivot low could send the stock down with momentum, with a first stop the gap fill at $18.00.

*DISCLOSURE: Scott Redler is long GLD, AAPL, BAC, F, V, JPM, SOHU.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.