People love a bargain, especially when they are shopping for groceries, personal grooming needs and general household products they know they will use if not now, but in the coming weeks.

Consumables are almost recession resilient, even in financially strapped times.

Since we all love a bargain, why not now take the opportunity to buy a company that produces these goods we buy regularly, especially when it is on sale?

We humans are funny creatures. We tend to shy away from declining stocks, worried we are catching the proverbial ‘falling knife’.

Proctor and Gamble (PG) is currently one of these stocks.

It’s brands include household names like; Braun, Gillette, Oral B, Head and Shoulders, Pantene, Wella, Olay, Vicks and the list can go on and on.

Personally, I love a bargain, whether it is in a super market or the stock market, especially when a fundamentally strong global brand (currently ranked 35th globally by Sync Force) is oversold based on technical indicators due to foreign currency headwinds in a slow but recovering US economy.

The following is what makes me want to add Proctor and Gamble to my long-term portfolio over the coming days. Here I will get straight to the point, as I believe it makes for efficient decision-making.

Please note, I am both a long-term deep value investor as well as a short-term trader who utilizes the combination of both fundamental and technical analysis to form a view of every investment I make. Doing so leads to low risk, superior market beating returns over the long run.

Fundamental Factors:

The Bad

Valuation of $50-$55 (approx.) based on adjusted discounted cash flow analysis, so PG is overvalued at current prices.

Forecasted weak Earnings per Share growth (EPS).

The Good

Earnings per share (EPS) has been good for the past 5 years.

Return on Equity (ROE) of 17.44% is more than satisfactory.

Net Debt to Equity (D/E) of 36.36% and is decreasing.

Long-term cash flow relative to reported profits is strong.

Long term funding surplus.

Technical Factors:

The Bad

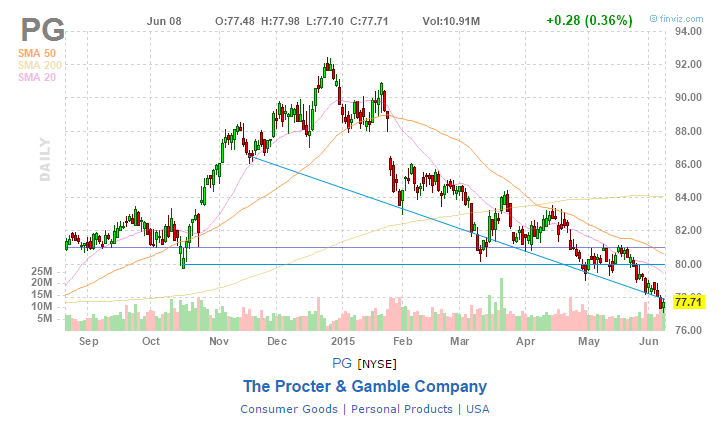

Clearly broken a number of key price support levels.

Currently below both the 50 and 200 day moving averages.

Seems to follow a confirmed down trend line.

The Good

The stock is clearly oversold on a variety of momentum indicators and buying volume seems to be increasing at these prices.

It is more than likely that value fund managers like myself are coming in to take advantage of these depressed prices.

Other Factors

For longer-term investments, I generally like to see who else is on-board with me and where the smart money has found its home.

In my opinion, actions always speak louder than words.

In this case, SEC filings report the following world-renowned deep value investors holding and building significant stakes in Proctor and Gamble.

Fund Managers % of Stock Outstanding % of Assets Managed

Donald Yacktman 1.05% 10.77%

Warren Buffett 1.95% 4.75%

Jeremy Grantham 0.58% 3.87%

Conclusion

Despite Proctor and Gamble being over valued and temporarily out of favor due to the reasons mentioned, it is a fundamentally strong company with leading global brands and smart money support.

It is also very rare for a great company like Proctor and Gamble to fall within valuation due to strong value investor demand, so I am happy to pay for quality in this instance.

I will be personally adding more Proctor and Gamble into our long-term portfolio over the coming days.

‘It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.’

Warren Buffett

For more information about how you can trade your way to financial freedom, please click here.