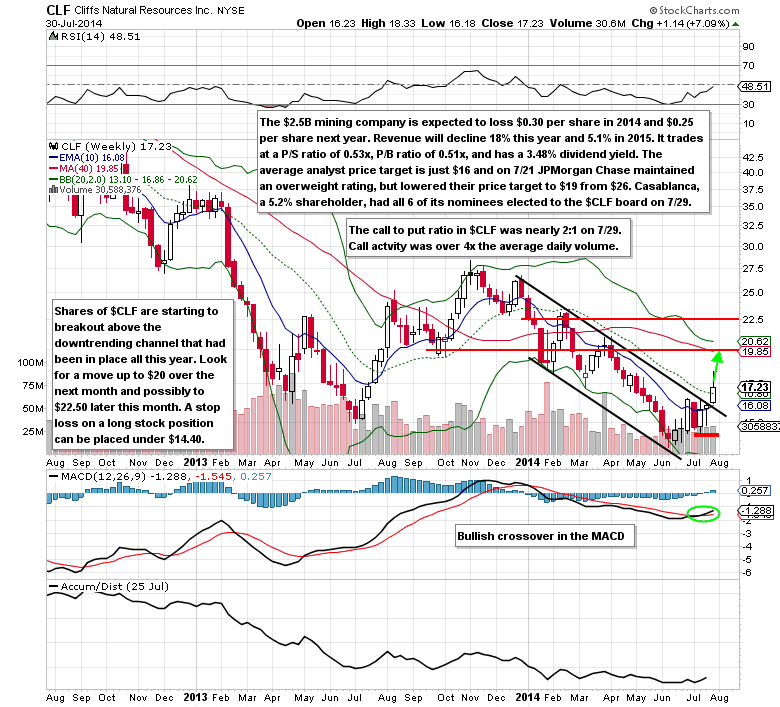

Shares of the $2.5 billion international mining and natural resources company, Cliffs Natural Resources (CLF), are down over 33% year to date. This underperformance has held Casablanca Capital, a 5.2% shareholder, to push for six seats on the board of directors. On July 29, the activist investor won as all six nominees were approved. This led to a 6.21% rise in the stock on heavy volume that led to a breakout above the downtrending channel that had been in place for all of 2014 (see chart below).

Options Activity

Option traders were bullish on the news as the call to put ratio was nearly 2:1. Call activity was over four times the average daily volume (larger percentage was bought at or near the offer).

On July 23, second quarter EPS came in at -$0.01 vs. the consensus Wall Street estimate of -$0.08. Revenues did come in light at $1.1B vs. the $1.5B estimate. Two bright spots were the projected 2014 iron ore production volume in Eastern Canada (7M tons vs. the 6M-7M tons estimate) and Asia Pacific (11M tons vs. the 10M-11M tons estimate).

Looking Ahead

Cliffs will continue to report losses for the foreseeable future, but they will narrow next year (-$0.30 in EPS in 2014 vs. -$0.25 in EPS in 2015). Revenue will decline 18.1% this year and just 5.1% next year. The stock trades at a price to sales ratio of just 0.53x and a price to book ratio of 0.51x. Compared to the SPDR S&P 500 ETF Trust’s (SPY) dividend yield of 1.82%, Cliffs has nearly twice the yield at 3.48%. The stock goes ex-dividend on August 13th with the $0.15 per share dividend being payable on September 2nd.

Options Trade Idea

Buy the Sep 20 $18/$20 call spread for a $0.60 debit or better

(Buy the Sep 20 $18 call and sell the Sep 20 $20 call, all in one trade)

Stop loss- None

First upside target- $1.20

Second upside target- $1.80

Disclosure: I’m long the Sep 20 $18/$20 call spreads for a $0.57 debit.

= = =

Mitchell’s Smart Money Report for unusual options activity featuring Dollar Tree (DLTR)