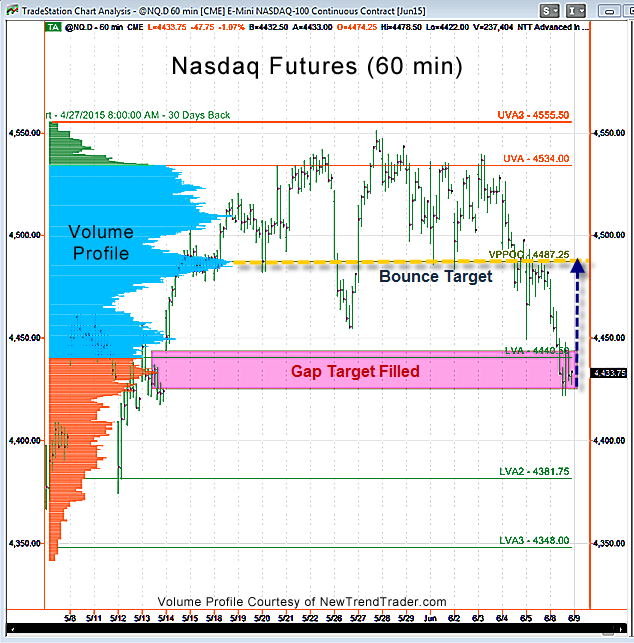

They say Monday’s belong to the bears. That was the case this week as the troublesome gap between 4428 and 4444 was finally filled. Volume was light during this act of good housekeeping, however, and the rest of the market seemed, well, somewhat bored.

It’s important not to mistake a quiet market for a weak market. In fact, there are many signs of covert bullishness. Small caps remain unperturbed and Tesla (TSLA), the poster child for animal spirits, effortlessly broke out of a base while the NQ scrubbed the floor. The VIX is around 15 and gold barely ticked higher on Monday, suggesting a market that is more complacent than cautious.

Lastly, I’m waiting for capitulation from the gold bugs (driving gold well below $1000) before the equity bull market is deemed fully cooked.

Short-term, after a few more tests of this gap zone, I expect a bounce back up to the Volume Profile Point of Control at 4487, a key S/R level we have referenced many times before.

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the Nasdaq futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs. If you would like to receive a primer on using Volume Profile, please click here