And a war of words is what we are seeing, with the U.S. and the European Union facing off against Russia over the future of the Ukraine. Half of Ukraine wants to join the European Union; the other half wants to join Russia.

The belligerent rhetoric got hotter over the weekend, when Russia sent troops to the Crimean part of Ukraine, and the Crimeans voted massively to secede and re-join Russia. Now the West is talking about “severe sanctions” and “economic catastrophe” for Russia. Markets are in turmoil.

But the U.S. Congress is on vacation until March 24, so apart from dire threats, don’t expect much action before then. There will be no shortage of bluster and angry words, but Congress seems to rate the Crimea crisis as less important than March break.

LITTLE EXCUSE FOR WAR

And the justification for a strong response from the European Union and the U.S. is not obvious. This can hardly be presented as an attempt to bring democracy to the downtrodden Crimeans.

In Sunday’s referendum about 80% of the eligible voters went to the polls (the U.S. has not seen a turnout like that since the presidential election of 1896) and almost 95% of them voted to re-join Russia. That’s not much justification for military action – if in fact military action were a realistic option.

But it isn’t. There may be skirmishes initiated by the recently-appointed-but-not-elected government of the Ukraine and the skirmishes may involve gunfire. But nobody is going to drop the Bomb to force the Crimeans to change their votes, and the market is coming to realize that.

WHAT’S NEXT FOR THE MARKET

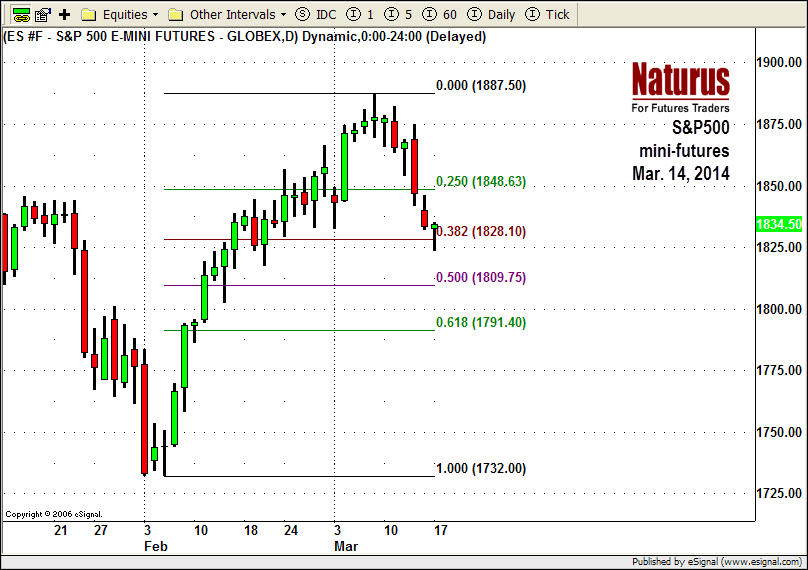

The U.S. equity markets are shaky, and we think the S&P futures (ES) will see some pretty wild swings this week.

But the real cause may be the Triple Witching effect, the volatility that always occurs when stock index futures, stock index options and stock options all expire on the same day, as they do this Friday.

The combination of tension in Europe and Triple Witching will rattle the market, and we have cancelled our short-term option trades as a defensive measure.

But for the longer term, we are still timid bulls. The June futures contract (ESM4) is now the front month for the S&P, and we still have a target around 1920-30 for the intermediate term.

This week a break below the support around 1824.00 – 1821.50 may lead the market down to 1805-1810. If we see 1805.25-1806.50 this week we will be cautious buyers.

Conversely, if the support holds the market could easily rally back to Friday’s high at 1846 or higher to 1852-54. After that, if we see prices around 1862.50-1859.50, we will be cautious sellers.

But the best trade this week might be to just stand on the sidelines and cheer. The sharks will be attacking the whales and no matter who wins, there will be blood in the water.

= = =

Options on the index futures are a good way to trade movements in the broad equity markets. For more information about how to use them, go to this link: http://members.naturus.com/options/

Chart caption: Short term Fibonacci retracements – SP500 mini futures (ES)