EUR/USD

The Euro found support on dips to below 1.3750 against the dollar during Tuesday and was generally firmer in cautious trading conditions.

Italian political and economic situation remained an extremely important focus as yields remained at elevated levels and briefly pushed towards the 7% level before a partial retreat.

Prime Minister Berlusconi failed to secure a majority of seats in a parliamentary budget vote which had developed into a key test of his authority. In response, Berlusconi stated that he would resign once planned austerity measures had been approved. Although there was some relief over a promise to resign, there was the prospect of a further period of uncertainty.

There was also a further delay in forming a new Greek government under Papademos as Opposition parties rejected EU demands for written assurances over approval of austerity measures.

Uncertainty remained a key feature as officials also discussed the longer-term financing issues. ECB members continued to reject calls for it to become the lender of last resort while Bundesbank Head Weidmann stated that central bank reserves were off-limit for the EFSF.

There was a further increase in money-market tensions and also the threat of capital repatriation by European banks. These repatriation flows continued to provide some net support for the Euro as it challenged levels near 1.3850 against the dollar. The US currency should gain some net support if there is a flow of funds out of emerging markets.

There was little changed in the attest US consumer confidence reading while regional Fed Presidents Plosser and Kocherlakota continued to voice concerns over the Fed’s guidance on future policy, although there was less concern over the immediate policy stance.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar failed to make any fresh ground against the yen on Tuesday and was subjected to renewed selling pressure during the New York session. There was strong reported buying interest close to the 78 level and there was a flurry of stop-loss buying once this level broke with the dollar dipping to the 77.55 area.

There has not been any follow-through on intervention by the Bank of Japan which has undermined expectations of bank action and reduced fear surrounding yen buying. The Japanese currency is also continuing to gain support from a lack of attractive alternatives.

The Chinese inflation data was broadly in line with expectations as it fell to 5.5% for October and expectations of a further decline could underpin risk appetite to some extent which would lessen yen support.

Sterling

Sterling continued to find solid buying support on dips during Tuesday and a break of resistance in the 1.6075 against the dollar area helped trigger a move to the 1.6125 area before a renewed drift lower. Sterling was unable to strengthen through 0.8550 against the Euro, but did find support close to the 0.86 area.

Although the economic data as a whole was not inspiring, it did provide some degree of relief. There was a small increase in manufacturing production for September while the BRC shop-price index recorded lower inflation of 2.1%. The NIESR estimated GDP growth of 0.5% in the three months to October which was unchanged from the previous estimate and provided some relief as it suggested that demand within the economy had not dipped very sharply at the beginning of the fourth quarter. There was still an underlying lack of confidence and some speculation that the Bank of England would take further action to expand quantitative easing further at Thursday’s monetary policy announcement.

There was still some evidence of defensive flows into the UK currency which provided protection as Euro-zone uncertainty remained at extremely high levels.

Swiss franc

There was further high volatility in the Swiss franc during Tuesday as the Euro pushed to highs near 1.2450 before retreating sharply. The dollar was unable to hold a position above the 0.9050 level against the franc.

There were further warnings against franc appreciation by National Bank officials with comments that the minimum Euro level would be defended aggressively and that the franc should weaken further given that it is still substantially over-valued. The remarks were tempered by comments that the bank was not pursuing a policy of competitive devaluation which triggered a sharp, albeit brief, franc rally.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

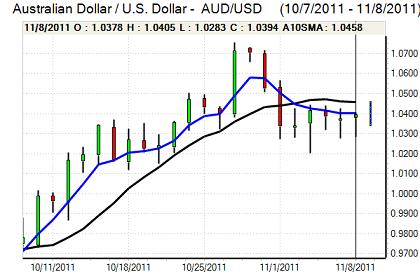

Australian dollar

The Australian dollar found support on dips to below 1.03 against the US currency on Tuesday and pushed to highs near 1.04 as risk appetite improved, although there was still an underlying lack of conviction.

The latest economic data provided some support for the currency as there was a 2.2% increase in home loans for October following a 1.2% increase the previous month and consumer confidence also improved.

There were still doubt surrounding the regional economy with increased fears that any reduction in Euro-zone bank lending would have an important impact in curbing Asian lending.