Smart traders look at the big picture and trade in the direction of the overall trend. But unexpected market shocks can change the picture in an instant—such as the earthquake and tsunami that hit Japan. We all know the crisis that has ensued; what we don’t know for certain yet is the long-term market impact. How has the big picture changed? Or have new opportunities to pursue old and established trends been revealed instead? One clue can be found in calendar spread trades in a few key commodities. I recommend using chart analysis to review past spread premiums/discounts to see if a paradigm takes hold due to the economic dislocation caused by this most horrible of disasters.

Specifically let’s look at lumber and copper. I believe these key industrial commodities will play a major role in reconstruction efforts in Japan. They are also very much in demand in China. Both lumber and copper have supply constraints, since both are capital intensive industries whose key exporters are located themselves in earthquake prone regions! In the case of lumber, it is British Columbia on the Pacific Coast of Canada and for copper it is Chile on the Pacific Coast of South America. Both regions are prone to earthquakes and are major exporters to Asia.

First, though, those new to futures need to understand what calendar spreads are, and how traders use them. Commodity futures contracts trade a variety of delivery months simultaneously. For example, you can buy or sell copper for April, May or June delivery in 2011, or April, May or June in 2012. Not all months are available to trade in all commodities; check the contract specifications with the exchange Web site for more details of the specific market you are interested in.

The different months of futures contracts bear different prices, creating interesting trading strategies. It follows then that a trader or investor may buy June 2011 copper and simultaneously sell 2011 copper because he or she believes copper for nearby delivery (June, being the closer month in time) will rise in price compared with copper for later delivery (September, being farther out in time). This strategy is an example of a calendar trade known as a “bull spread.” Bull spreads are a bullish play on commodity futures given bull markets in commodities typically begin with an initial demand spike (or a sudden supply disruption) that overwhelms nearby (in time) supply, or the regular demand cannot be met because of the sudden shortage of available supply. Thus, a commodity trading in the spot market (nearest delivery month futures contract) will rally in price compared with a later delivery month. That’s because the demand spike is happening now, and may well be transitory.

The fact that demand may well continue to outstrip supply will be observed in a condition known as “backwardation” and it is measured by the spot “convenience yield.” Roughly speaking, convenience yield of a commodity is the rarely occurring percentage premium in the price of a cash-market traded commodity over a forward-delivery contract, as quoted in the futures market. In simple terms, this means end users need their commodity now, and are worried about getting enough of it. The end user is worried enough to pay a premium to have it now, over waiting for more supply and lower prices later on.

Normal conditions of supply and demand incorporate inventories for later use. The buying and storing of commodities for later use means prices are likely to be higher going further out in time. They are typically higher because the higher “future” price incorporates the spot purchase price and the opportunity cost of financing the purchase, plus storage costs over the term until the delivery to the end user/buyer is made and paid for. This is the normal condition we find in the futures markets, and it is termed “contango.”

Occasionally, futures contracts trade at higher than carry prices because spot prices become depressed when buyers disappear for whatever reason and/or supply is dumped onto the market. Traders that anticipate this condition of “carry plus” in a given commodity futures market may initiate a bear spread in the commodity futures contract by shorting nearby contracts and simultaneously buying more deferred delivery futures. They hope to profit from continued weakness in nearby prices relative to a more “normal” futures price further out in time.

Now let’s put these concepts into practice given the topic at hand—the commodities markets and Japan—by looking at the spread between delivery months in copper and lumber. Lumber prices peaked in early January basis the January 2011 contract. Lumber was in fact in backwardation if you compare the price of the July 2011 contract to the January 2011 contract. Since the New Year, the spread between the current front-month (May 2011) and the July 2011 delivery contract has reverted to the normal contango and now even exceeds the normal carry of about $15 to $20 per delivery month to delivery month at a current value of $20 plus premium to the July lumber over the May (spot) lumber.

What does this mean? This can be indications that bear spreading by producers and wholesalers may have run its course already. Although, continued buying in more forward months by speculators could push this positive carry even further. Or, perhaps reconstruction begins in earnest, we will see a quick reversal to backwardation! Keep an eye on the July/September spread in lumber, which currently sits around $9 premium of September over July.

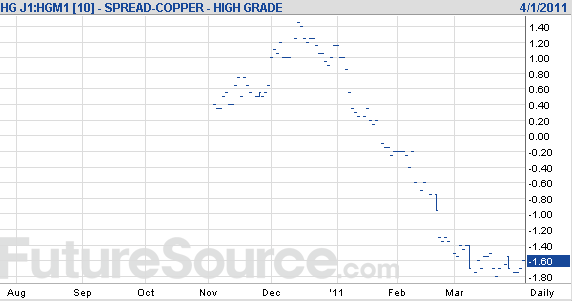

Copper prices peaked at $4.6255 a pound on February 14, 2011. Since then, the market has consolidated between $4 and $4.50. Copper had been in backwardation basis the April 2011 and June 2011 spread right up to the New Year, then subsequently began to lose the forward discount. At around the time of the earthquake in Japan, copper’s contango began to weaken from a carry of 1.6 cents per pond to a current carry of around 1.45 cents per pound premium to June over April copper. Conclusion: the copper trade is less influenced by Japan’s current woes and more influenced by China’s consumption and global trade in general.

Nonetheless, long-term, copper will likely be a key input to the rebuilding efforts in Japan, the world’s fourth-largest copper consumer. However, it’s important to keep in mind ramping up in copper demand in Japan could be offset by slackening in global industrial copper demand caused by the disruption to the global supply chain and ongoing efforts to cool China’s economy. There is also the fight to contain incipient inflation in the EU, which could cool commodities.

Great trades happen infrequently and are usually sparked by some unique or rare event that gets the trend going in a new direction. Calendar spreads and knowing how to spot the bull or bear credentials of a given price curve in futures can be a key clue to the beginnings of the next great trading opportunity. Thus, these spread bear (pun intended!) watching!

If you have any questions about this topic or would like more information about specific trading strategies, please feel free to contact me.

Smart traders look at the big picture and trade in the direction of the overall trend. But unexpected market shocks can change the picture in an instant—such as the earthquake and tsunami that hit Japan. We all know the crisis that has ensued; what we don’t know for certain yet is the long-term market impact. How has the big picture changed? Or have new opportunities to pursue old and established trends been revealed instead? One clue can be found in calendar spread trades in a few key commodities. I recommend using chart analysis to review past spread premiums/discounts to see if a paradigm takes hold due to the economic dislocation caused by this most horrible of disasters.

Specifically let’s look at lumber and copper. I believe these key industrial commodities will play a major role in reconstruction efforts in Japan. They are also very much in demand in China. Both lumber and copper have supply constraints, since both are capital intensive industries whose key exporters are located themselves in earthquake prone regions! In the case of lumber, it is British Columbia on the Pacific Coast of Canada and for copper it is Chile on the Pacific Coast of South America. Both regions are prone to earthquakes and are major exporters to Asia.

First, though, those new to futures need to understand what calendar spreads are, and how traders use them. Commodity futures contracts trade a variety of delivery months simultaneously. For example, you can buy or sell copper for April, May or June delivery in 2011, or April, May or June in 2012. Not all months are available to trade in all commodities; check the contract specifications with the exchange Web site for more details of the specific market you are interested in.

The different months of futures contracts bear different prices, creating interesting trading strategies. It follows then that a trader or investor may buy June 2011 copper and simultaneously sell 2011 copper because he or she believes copper for nearby delivery (June, being the closer month in time) will rise in price compared with copper for later delivery (September, being farther out in time). This strategy is an example of a calendar trade known as a “bull spread.” Bull spreads are a bullish play on commodity futures given bull markets in commodities typically begin with an initial demand spike (or a sudden supply disruption) that overwhelms nearby (in time) supply, or the regular demand cannot be met because of the sudden shortage of available supply. Thus, a commodity trading in the spot market (nearest delivery month futures contract) will rally in price compared with a later delivery month. That’s because the demand spike is happening now, and may well be transitory.

The fact that demand may well continue to outstrip supply will be observed in a condition known as “backwardation” and it is measured by the spot “convenience yield.” Roughly speaking, convenience yield of a commodity is the rarely occurring percentage premium in the price of a cash-market traded commodity over a forward-delivery contract, as quoted in the futures market. In simple terms, this means end users need their commodity now, and are worried about getting enough of it. The end user is worried enough to pay a premium to have it now, over waiting for more supply and lower prices later on.

Normal conditions of supply and demand incorporate inventories for later use. The buying and storing of commodities for later use means prices are likely to be higher going further out in time. They are typically higher because the higher “future” price incorporates the spot purchase price and the opportunity cost of financing the purchase, plus storage costs over the term until the delivery to the end user/buyer is made and paid for. This is the normal condition we find in the futures markets, and it is termed “contango.”

Occasionally, futures contracts trade at higher than carry prices because spot prices become depressed when buyers disappear for whatever reason and/or supply is dumped onto the market. Traders that anticipate this condition of “carry plus” in a given commodity futures market may initiate a bear spread in the commodity futures contract by shorting nearby contracts and simultaneously buying more deferred delivery futures. They hope to profit from continued weakness in nearby prices relative to a more “normal” futures price further out in time.

Now let’s put these concepts into practice given the topic at hand—the commodities markets and Japan—by looking at the spread between delivery months in copper and lumber. Lumber prices peaked in early January basis the January 2011 contract. Lumber was in fact in backwardation basis the July contract. Since that time, the front month (May 2011) spread has reverted to the normal contango and even exceeds the normal carry of about $15 per delivery month to delivery month at a current value of $20 premium to the July lumber over May (spot) lumber.

What does this mean? This could be an indication that bear spreading by producers and wholesalers through hedging may have run its course already. Continued buying in more forward months by speculators could push this positive carry even further. Or, perhaps once reconstruction begins in earnest we will see a quick reversal to backwardation! Keep an eye on the July/September spread in lumber, which currently sits at around $7 premium September over July.

Copper prices peaked at $4.6255 a pound on February 14, 2011. Since then, the market has consolidated between $4 and $4.50. Copper had been in backwardation basis the April 2011 and June 2011 spread right up to the New Year, then subsequently began to lose the forward discount. At around the time of the earthquake in Japan, copper’s contango began to weaken from a carry of 1.6 cents per pond to a current carry of around 1.45 cents per pound premium to June over April copper. Conclusion: the copper trade is less influenced by Japan’s current woes and more influenced by China’s consumption and global trade in general.

Nonetheless, long-term, copper will likely be a key input to the rebuilding efforts in Japan, the world’s fourth-largest copper consumer. However, it’s important to keep in mind ramping up in copper demand in Japan could be offset by slackening in global industrial copper demand caused by the disruption to the global supply chain and ongoing efforts to cool China’s economy. There is also the fight to contain incipient inflation in the EU, which could cool commodities.

Great trades happen infrequently and are usually sparked by some unique or rare event that gets the trend going in a new direction. Calendar spreads and knowing how to spot the bull or bear credentials of a given price curve in futures can be a key clue to the beginnings of the next great trading opportunity. Thus, these spread bear (pun intended!) watching!

If you have any questions about this topic or would like more information about specific trading strategies, please feel free to contact me.

Chris James is in Business Development in Lind-Waldock’s Toronto office. He can be reached at 1-800-268-9294 or via email at cjames@lind-waldock.com.

Futures and Forex trading involves a substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Please carefully consider your financial condition prior to making any investments. Not to be construed as solicitation.

Lind-Waldock, a division of MF Global Canada Co.

MF Global Canada Co. is a member of the Canadian Investor Protection Fund.

(c) 2011 MF Global Holdings Ltd. 123 Front St. West, Suite 1601, Toronto, ON M5J2M2. Toll-free 877-501-5463. www.lind-waldock.ca