Who doesn’t love Starbucks? It’s a short list I am sure. I am honestly not a huge coffee fan but it will be a cold day in the Caribbean before I turn down a Venti size double chocolate chip frappuccino. I quite enjoy their blueberry muffins too. I heard a rumor once, that in New York City, one could walk out of a Starbucks and there would stand another Starbucks. This happened to me once, when I was visiting New York City. I felt as if I were standing on the earth’s horizon. It was a remarkable sight.

Set Up

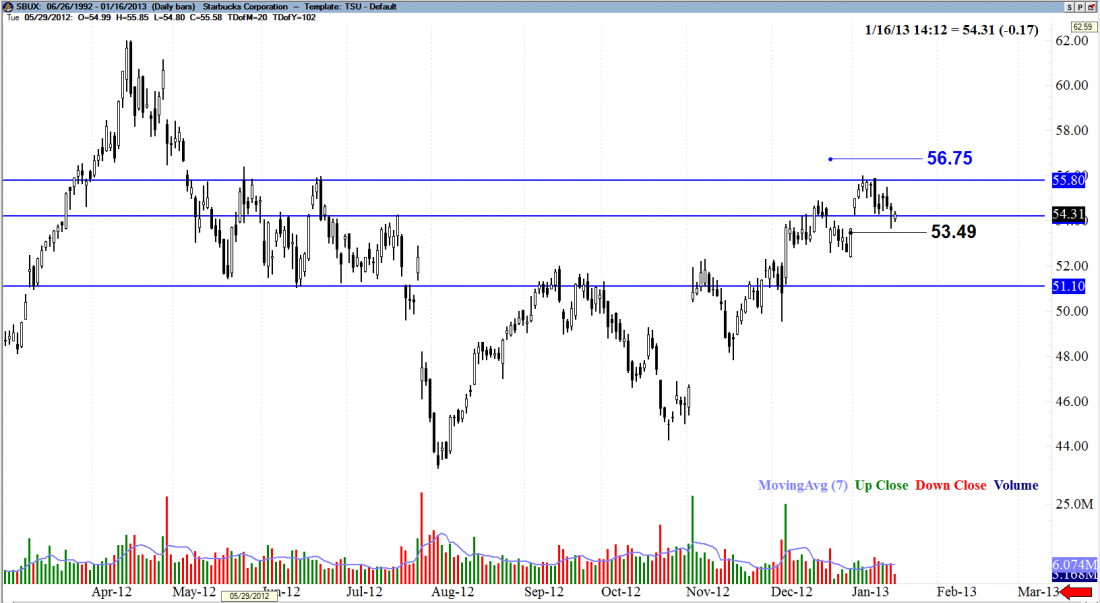

Starbucks, like many companies, is quite exciting to trade. Those who trade it are disciplined, making it quite easy to chart. There is a very strong and obvious resistance at $55.80. There is a gap which formed after the 05/04/2012 candle. That gap and the resistance at $55.80 is a price where sellers have reaped multiple benefits from selling short the stock there.

Key Levels

For a bullish perspective, I feel a close above $56.75 would bring about a nice bullish continuation, especially because we have a giant gap back in November that has not filled. We have a lower wick on Tuesday’s candle, indicating buying pressure. Earnings are right around the corner on 01/24/2013.

I personally do not trade over earnings on stocks or options. It’s too much of a 50/50 gamble and it seems the house always beats me. I did place an aggressive bearish entry at $53.49. Mitigation of risk would be easy and simple and the chance of a 10% put option move if that price gets triggered is quite good, in my opinion. SBUX is also a great stock for those who want to own it long term, as the premium for covered calls is quite good and the stock pays dividends.