August crude oil closed up $1.66 at $70.33 a barrel yesterday. Prices closed nearer the session high and were supported by some U.S. refinery problems and supply worries coming out of Africa. Bulls do have the near-term technical advantage. The next downside price objective for the crude oil bears is to produce a close below solid technical support at this week’s low of $66.37. The next upside price objective for the bulls is producing a close above solid technical resistance at the June high of $73.90 a barrel. First resistance is seen at yesterday’s high of $70.93 and then at $72.00. First support is seen at $70.00 and then at $69.00.

Wyckoff‘s Market Rating: 7.0.

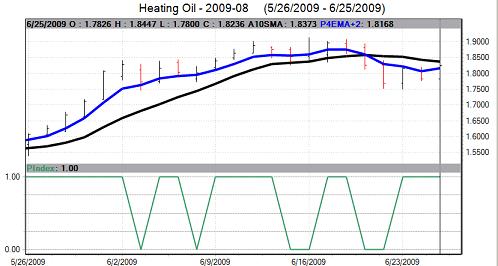

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

August heating oil closed up 431 points at $1.8258 yesterday. Prices closed nearer the session high yesterday. The bulls have the near-term technical advantage. The bulls’ next upside price objective is closing prices above solid technical resistance at the June high of $1.9138. Bears’ next downside price objective is producing a close below solid technical support at $1.7000. First resistance lies at yesterday’s high of $1.8447 and then at $1.9000. First support is seen at $1.8000 and then at yesterday’s low of $1.7800.

Wyckoff‘s Market Rating: 6.0.

August (RBOB) unleaded gasoline closed up 535 points at $1.9035 yesterday. Prices closed near mid-range. A minor bearish pennant pattern has formed on the daily bar chart, but an up day on Friday would negate that pattern. The next upside price objective for the bulls is closing prices above solid technical resistance at last week’s high of $2.0844. Bears’ next downside price objective is closing prices below solid support at $1.7000. First resistance is seen at yesterday’s high of $1.9277 and then at $1.9500. First support is seen at $1.8750 and then at yesterday’s low of $1.8471.

Wyckoff‘s Market Rating: 6.0.

August natural gas closed up 12.4 cents at $4.03 yesterday. Prices closed nearer the session high yesterday. The key “outside markets” were bullish for nat gas futures yesterday, as the U.S. stock indexes were higher, crude oil was solidly higher and the U.S. dollar was weaker. The next upside price objective for the bulls is closing prices above solid technical resistance at the June high of $4.574. The next downside price objective for the bears is closing prices below solid technical support at June low of $3.71. First resistance is seen at yesterday’s high of $4.104 and then at $4.25. First support is seen at this week’s low of $3.871 and then at $3.75.

Wyckoff‘s Market Rating: 2.5.