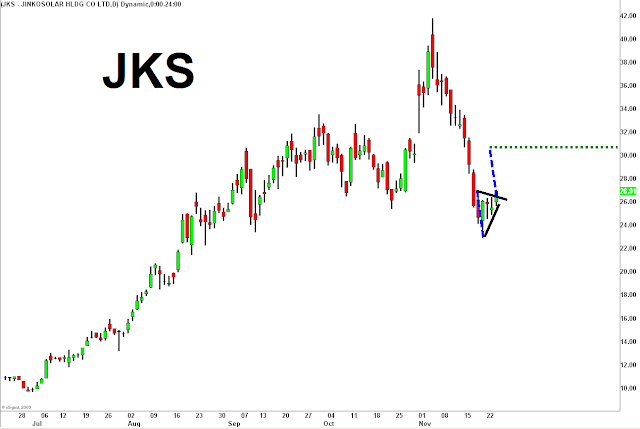

JinkoSolar Holding Co., Ltd. (NYSE:JKS) operates as a solar energy company which makes mono-crystalline and multi-crystalline silicon wafers. The stock just peaked in early November above 40 with the rest of the solar group. Wire houses did a botched up secondary for the “preferred clients” at 36, which added to the intensity of the down move.

Over the last five trading days the stock has put in a lower consolidation, and I believe it’s ready to bounce. I’m in tier one long here from around 26 and added tier two through $26.20-26.40. The first technical target on the trade is $28-$28.50, then ultimately it could get to $30.50-31.50. The stop loss is 25.

*Disclosure: Long JKS

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs.