U.S. non-farm payrolls surprised traders Friday morning with a higher-than-expected reading. Non-farm payrolls rose to a seasonally adjusted 175,000, from 149,000 in the previous month, which figure was revised down from 165,000.

However, the labor department also said that the unemployment rate rose slightly to 7.6% from last month’s 7.5%.

The U.S. dollar index has already started to pick up somewhat after the announcement after having lost all the gains in the month of May.

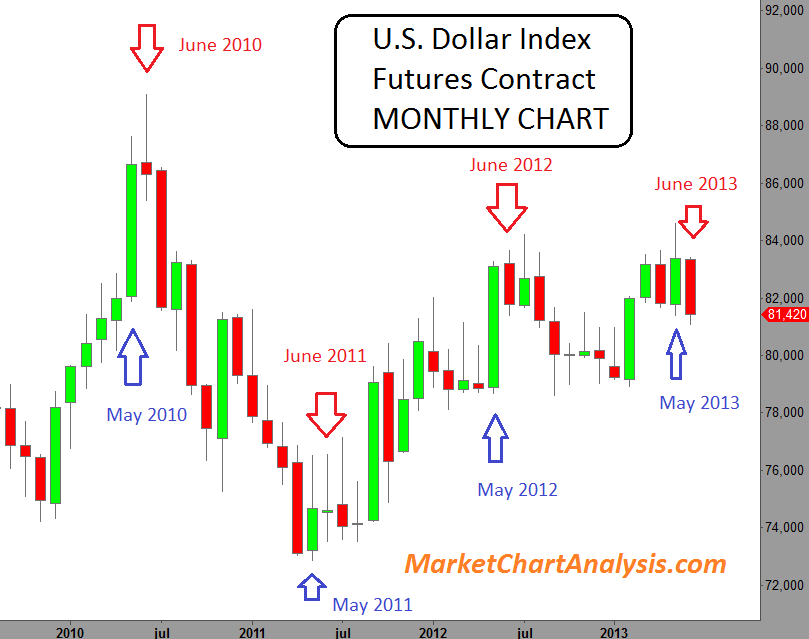

MONTHLY CHART

This is the fourth year in a row in which the month of May has turned out to be good for the greenback. Most traders who like to “sell in May and go away” have lost some nice upswings in the USDX during the month of May.

However, June doesn’t seem to have a good track record for the U.S. dollar index as we can see on the monthly chart.

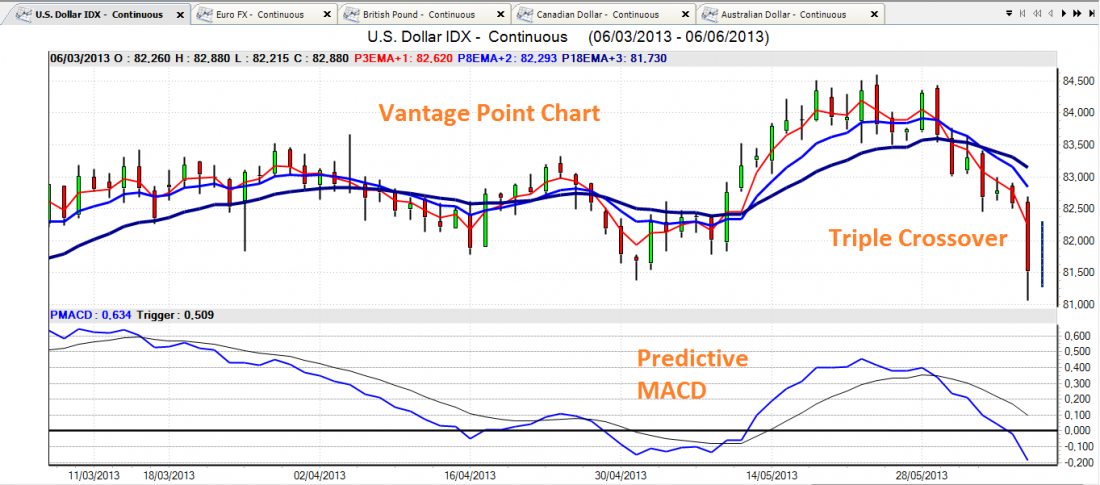

On the Vantage Point chart the underlying sentiment looks bearish, although the Triple crossover and Predictive MACD currently display large divergences that are indicating a possible oversold status.

BOTTOM LINE

If one believes that there is some truth behind the effect of seasonality, then we should trade carefully as the month of June doesn’t usually look good for the U.S. dollar index. We can already see how the market has started to fade the dollar bull rally of May.

However, this good reading on the jobs report could help recover some of these June losses on the greenback as we wait to see how he Fed reacts to this number.

= = =

Click here for Amar Daryanani’s suggestions on how to use MACD and RSI.