Merck (MRK), the global healthcare company, is up 15.56% year- to-date, which is a slight underperformance to the S&P 500’s 17.39% gain for 2013. Despite the underperformance for 2013, shares of Merck are sitting up for another run-up into earnings like we’ve saw ahead of the last two quarterly reports. Third quarter earnings are expected to be announced on Monday, October 28.

A TECHNICAL TAKE ON MERCK

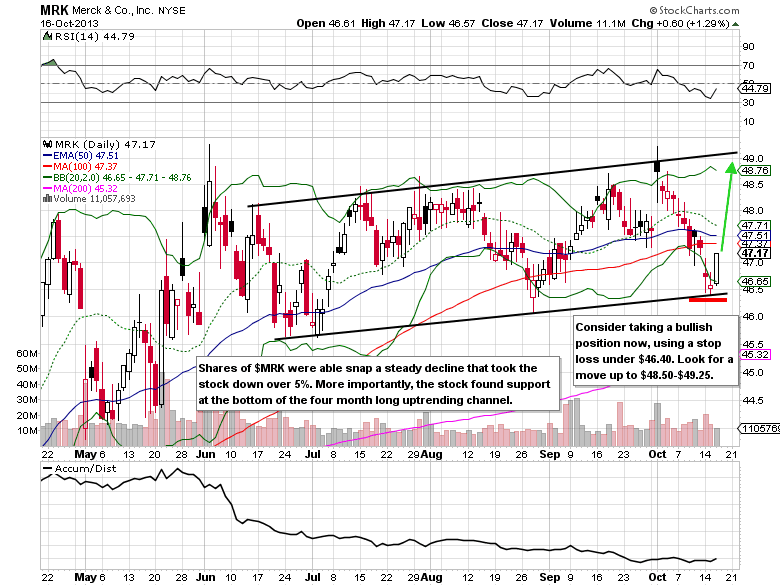

Merck has been trading in an uptrending channel for the last four months. On Wednesday, October 16, the stock tested the bottom of the channel and finished higher by 1.29%. This type of price action sets up for a low risk buying opportunity. Longer-term, Merck is also putting in a higher low on the weekly chart that could result in a $5 handle in the coming months.

MERCK OPTIONS TRADE IDEA

Buy: the Oct 25 weekly $47 call for $0.55 or better

Stop loss: $0.30

Upside target: $1.50-$2.25

Read my Free Trade of the Day featuring Weatherford International here.