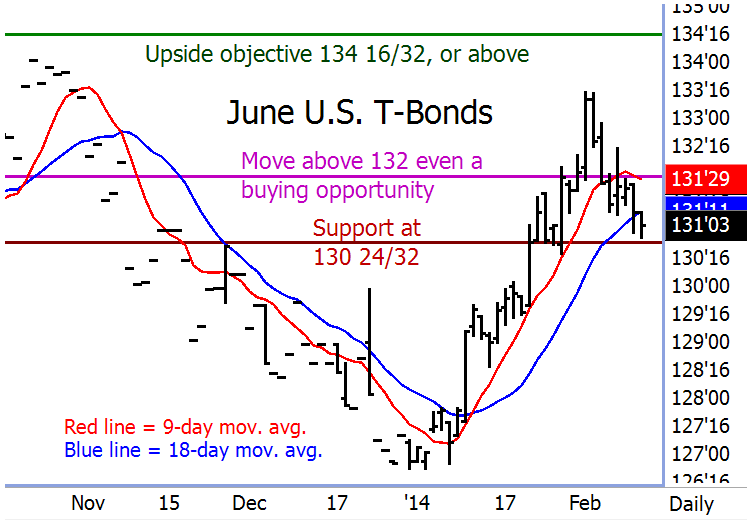

June U.S. Treasury bond futures a buying opportunity on fresh price strength.

See on the daily bar chart for June U.S. T-Bond futures that prices have backed down from the recent high on profit-taking pressure. However, the bulls still have the overall near-term technical advantage. See that the shorter-term moving averages I follow (9-day and 18-day) are still in a bullish mode as the 9-day is above the 18-day moving average. A move above chart resistance at 132 even would revive the bulls, give them upside technical momentum, and it would become a buying opportunity. The upside price objective would be 134 16/32, or above. Technical support, for which to place a protective sell stop just below, is located at 130 24/32.