INSANITY!

INSANITY!

That’s what we have today (and what we’ve been having all month) as the markets celebrate the fact that neither the US consumer or the Euro is dead – yet. Holiday sales are apparently up 16.4% from last year with 10% of those sales being IPhones and Ipads so we can thank the actually dead Steve Jobs for saving the markets from a total meltdown this month as we were on track for the worst November EVER until today.

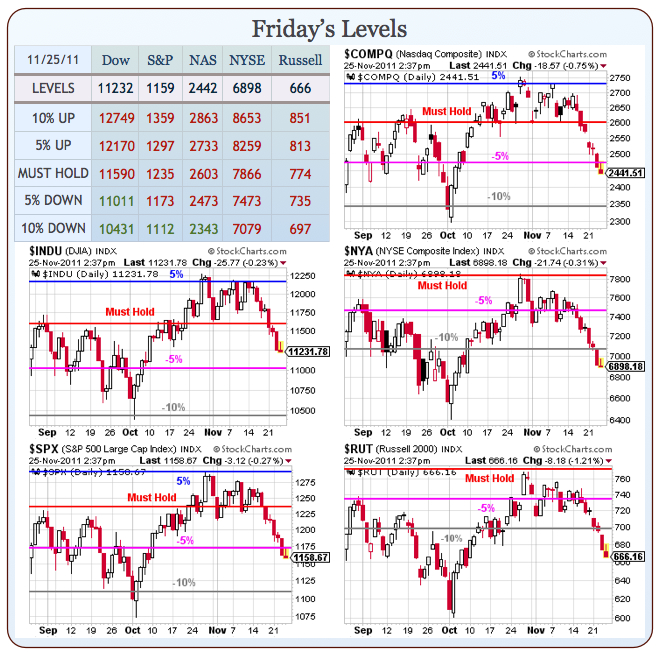

The DOOM meter was certainly set to 100 and, in fact, 100 is about how low the McClellan Oscillator went on Friday – to a state of oversold not matched since August 8th, when the Dow bottomed out at 10,600 so holding 11,200 in this protracted sell-off was a victory, of sorts, for the bulls and certainly a victory for those of you following our Big Chart – which made us perhaps the ONLY newsletter that was bullish on Friday, when I laid out my bullish case and right in the main post – for free – suggested long ideas on:

- Oil Futures (/CL): Was $95, now $100 – up $5,000 per contract

- Gasoline Futures (/RB): Was $2.50, now $2.54 – up $1,680 per contract

And, in Member Chat – our Morning Alert had the following trade ideas:

- FAS Dec $48/55 bull call spread at $3, selling the $40 puts for $2.40 for net .60 on the $7 spread. 5 in the WCP on that one.

- FXE Dec $132/135 bull call spread at $1.20, selling the $129 puts for $1.10 for net .10 on the $3 spread.

- JPM Jan $25 puts can be sold for $1.20

- AA 2013 $7.50 puts can be sold for $1.28.

- VLO June $17 puts can be sold for $2.05

We also speculated on an aggressive AMZN long play with the Dec $200 calls at $2.50 but, overall, we take this 2% bounce after a 10% drop with a grain of salt. As I said to Members in the alert: Just like we watched with amusement while things fell earlier this week, we should take a move up just as lightly until we cross back over our Must Hold Lines – to some extent, we have selling fatigue driving this move – keep in mind my bullish discussion on hyperinflation is more…

We also speculated on an aggressive AMZN long play with the Dec $200 calls at $2.50 but, overall, we take this 2% bounce after a 10% drop with a grain of salt. As I said to Members in the alert: Just like we watched with amusement while things fell earlier this week, we should take a move up just as lightly until we cross back over our Must Hold Lines – to some extent, we have selling fatigue driving this move – keep in mind my bullish discussion on hyperinflation is more…