Here we go again!

Here we go again!

Just when you thought the market couldn’t get more pumped up – this morningCIThas been”rescued” andGS israising their price target on the S&P to 1,060 (up13%) by the year end. Kudos to our government for not bailingout CIT – it turns out they DID havealternativesto having their bones picked clean by GS and JPM although perhaps this only puts off the inevitable, we’ll have to see. I see CITtrading at $1.50 pre- market and they make a tempting short here asnot actually filing for bankruptcydoesn’t meansyour have “saved” your company and what’s good for the bondholders is often not what’s good for common stockholders….

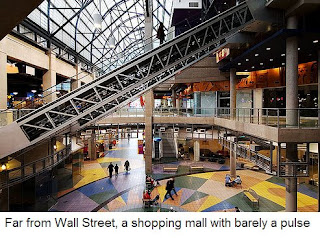

Does this mean the stimulus is kind of working? Bondholders have $3Bn to give CIT and structure a deal that does not require government intervention. The free market triumphs – maybe. There is certainly no shortage of companies in loan trouble asU.S. banks have been charging off soured commercial mortgages at the fastest pace in nearly 20 years, according to an analysis by The Wall Street Journal. At that rate, losses on loans used to finance offices, shopping malls, hotels, apartments and other commercial property could reach about $30 billion by the end of 2009.

The commercial real-estate market, valued at about $6.7 trillion, represents 13% of the U.S.’s gross domestic product. But the recession and scarce credit are pushing more commercial developers and investors into default. Meanwhile, property values continue to decline, and banks are required to record a loss on any troubled real-estate loans where the appraised value falls below the amount owed. Delinquencies on commercial mortgages held by banks more than doubled to about 4.3% in the second quarter from a year earlier. In contrast to home loans, the majority of which were made by about 10 lenders, thousands of U.S. banks, especially regional and community banks, loaded up on commercial-property debt.”Net charge-offs to date have been highly inadequate,” said Richard Parkus, head of commercial mortgage-backed securities research at Deutsche Bank. “This is clearly a problem that is being pushed out into the future.”

The commercial real-estate market, valued at about $6.7 trillion, represents 13% of the U.S.’s gross domestic product. But the recession and scarce credit are pushing more commercial developers and investors into default. Meanwhile, property values continue to decline, and banks are required to record a loss on any troubled real-estate loans where the appraised value falls below the amount owed. Delinquencies on commercial mortgages held by banks more than doubled to about 4.3% in the second quarter from a year earlier. In contrast to home loans, the majority of which were made by about 10 lenders, thousands of U.S. banks, especially regional and community banks, loaded up on commercial-property debt.”Net charge-offs to date have been highly inadequate,” said Richard Parkus, head of commercial mortgage-backed securities research at Deutsche Bank. “This is clearly a problem that is being pushed out into the future.”

Yes, I know – as I said in the weekend wrap-up, we have committed the great sin of being skeptical based on fundamentals and we may have cashed out too early by taking things off the table on Friday and, judging by the pre-market (8am), it looks like we were also wrong not to fully cover our long DIA…

Yes, I know – as I said in the weekend wrap-up, we have committed the great sin of being skeptical based on fundamentals and we may have cashed out too early by taking things off the table on Friday and, judging by the pre-market (8am), it looks like we were also wrong not to fully cover our long DIA…