Although the Q2 period covers the days between the beginning of April and the end of June, because the fund is in its infancy (it launched June 1st), the period covered here is only one month. Also, considering the fact that the fund is of a long-term nature (i.e. not looking for quick, in-and-out-like trading profits), monthly reports are particularly unrevealing. Nevertheless, it is important that investors receive timely updates on their investments, and this will serve as the first such update.

The market value of one share of KVF rose by 0.25% over the month of June (compared to a -2.4% return of the benchmark index) bringing the value of each share to $10.03 versus the opening share value of $10.00. While it would be nice to say that the average stock in KVF increased by almost 3% in the month as compared to the benchmark, this was not the case. Portfolio returns were aided by favourable currency movements between the Canadian and US dollars. There are no plans for the fund to hedge USD/CAD currency fluctuations. As such, currency movements could affect returns over short periods, but are not likely to be a factor over the long term.

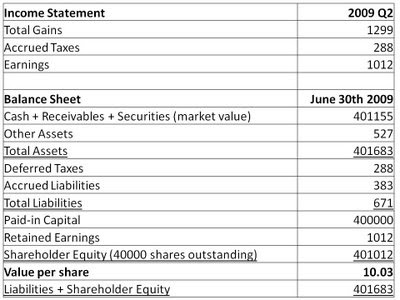

The top performing stock in the portfolio was up 18.1%, while the least performing stock dropped 7.3%. As perverse as it may sound, this dropping stock is good news for the fund’s long-term returns, since it offers up an excellent security at better prices. The fund’s balance sheet and income statement are included below. (Note that securities are classified as ‘held for trading’ for accounting purposes and are thus listed at market value, with unrealized gains and losses included in the income statement.)