The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!

Today’s Golden Sunrise

Friday, May 21, 2010

Hours of daily research consolidated for you

Kennin…are you scairt?

Many years ago when my beloved oldest son John was 2, he was bundled up and taking his first boat ride with my sister Carolyn and brother-on-law Michael in their ski-boat. Zipping along pretty good, it got a little bouncy as things tend to do on the water, my sister heard a little voice say “Kennin, are you scairt?”. When she assured my John it was safe, he relaxed.

I have been asking everyone I know to tell me the markets are safe. Other than LoudMouth Larry who follows Cacophonous Cramer, no one feels too secure about the state of things.

Everyone is blaming Europe (and not without some justification) but the US had plenty of negativity itself yesterday:

- The jobless claims increased by 25,000 when an improvement was expected.

- Problem banks listed by the FDIC grew from 702 to 775; after 60+ have already been closed this year.

- The Leading Economic Indicators for April declined .1% when a plus .2% was expected.

- The Treasury will auction $113 Billion in debt next week-$42b twos on Tues (42 2s on Tues), 40b 5s on Wedn, 31B 7years on Thursday. In a liquidity lean market that’s a lot to absorb.

It is hard to describe how bad yesterday was-

All 197 IBD groups were negative. On huge volume.

The stocks on the move, NSYE, had zero up, 46 down.

The stocks on the move NASdaq had 1 up, 45 down.

The NYSE stocks above their 200 day moving average has dropped to 465%. This number was 84% on May 3rd.

NYSE had 168 stocks up, 3015 down.

NYSE volume was 28.4 million shares up, 2.076 Billion Down.

Nasdaq had 242 stocks up, 2564 down,

Nas volume was 73.6 million up 3.1986 Billion down.

New highs 14, New lows 227, many days in April with 800,900 NHs

98 of the IBD 100 were negative

The fear index vix family have all soared into the40s..

On the stocks up quick review, 7 of the up moves were stocks and to fill out the daily 50, IBD had 43 bearish etfs.

The NYSE on a 15 minute chart for yesterday to illustrate the day.

Worldwide…every major market is negative…10 days ago only France and Germany were. The BRICS, which are supposed to be the economic salvation show Brazil -21.4%, Russia -11.2%, India -8.8% and China -20%+.

Commodities have been crushed beyond comprehension. This is a weekly chart.

The CRB above is a 52 week low-tends to be heavy in oil so some logic there. Copper which is a key gauge of economic health has had some tough going in the last couple of weeks.

The momentum indicator shows these all oversold but in a raise cash market in doesn’t matter. It looks like a long way down before copper finds some support.

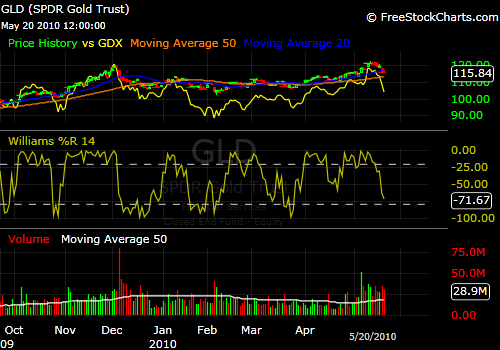

Gold stocks have been taking a beating as well and one some significant volume as well. It has broken the 20dma so next stop could be 50dma. The GLD is the etf for gold. The GDX is the yellow trendline which has been tracking just below the price of the physical which is unusual in and of itself in a rising market but the stocks have turned down much more sharply than the metal.

There is more than one market for gold. The physical metal represented by futures, by options, by the etfs like gld, cef and others, which are “paper gold”. The physical metal itself in the form of bullion in various forms and coins which have a metal and numismatic combination of value.

Paper gold bounces up and down in increasing spans of movement and is affected by etfs, the hedge funds, by central banks. Gold you own and hold is not. Gold you hold is the subject of a video on youtube called “Chinese dumping worthless currency for gold”. I urge you to watch it…3 minutes…that level of demand is a very good likelihood of happening here. I won’t be in those crowds having established holdings in lesser demand periods. The Crudlow King Dollar Crapola would be greeted with the derision directed at Tim Geithner addressing Chinese students when he uttered the same drivel.

ThThe GLD with the GDX trendline:

The Senate passed the financial reform bill with the help of Scott Brown, the Republican Senator from Massachusetts, who assisted the Democrats again to cut off debate and bring the bill to a vote. The Tea Party folks who got him elected must be pretty happy with that.

Rays pounded the Yankees again.

Buy some gold when you can and while you still can.

JohnR

Goldensurveyor.com