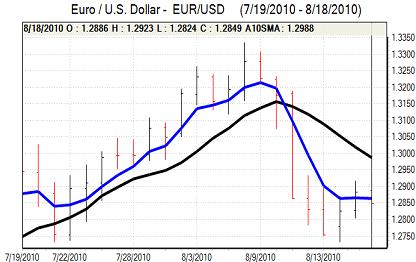

EUR/USD

After retreating during the Asian session, the Euro held a firm tone in European trading on Wednesday and continued to probe resistance levels above the 1.29 level against the dollar. Risk conditions remained calmer following the overnight Wall Street gains, but markets still had important reservations over the global economy which dampened optimism.

There were no major economic releases during the day and trading conditions were generally subdued in holiday-thinned trading.

Although immediate debt fears have eased following successful bond auction results, there is still an important lack of underlying confidence in the Euro-zone area. In particular, there are fears that the divergence in growth trends between German and the weaker Euro members will intensify tensions within the next few months.

There was a further decline in dollar Libor rates on the day, extending the decline to over a month and this does not suggest that there is strong liquidity-related demands for the US currency at this stage. The dollar will also continue to be hampered by a lack of yield support and expectations that the Federal Reserve will maintain a highly-expansionary policy.

The dollar is, however, still in a position to gain defensive support and the Euro again failed to hold above the 1.29 level. As liquidity declined, the Euro retreated back to the 1.2850 area later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar resisted a further serious test of support in the 85 area against the yen during the European session on Wednesday. There has been no major increase in verbal intervention by Japanese officials and the Bank of Japan still appears relatively calm over the situation. Nevertheless, markets will remain wary of further action and this is deterring yen buying.

The dollar is still suffering from a lack of yield support, especially after a run of disappointing housing-related data and this is capping any investment flows into the US currency. There is also a wider lack of confidence in the Euro-zone area which is discouraging capital outflows.

In this environment, the yen remained resilient and the dollar was trapped below 85.60 as narrow ranges dominated.

Sterling

Sterling was subjected to selling pressure in early Europe on Wednesday with speculation over a dovish set of Bank of England minutes. In particular, there were rumours that some members might have voted for an easing of policy and Sterling dipped to lows just below 1.55 against the dollar.

In the event, there was a 8-1 vote for holding interest rates unchanged at 0.50%. Sentance again dissented from the verdict and called for a 0.25% increase in interest rates. The minutes stated that members had considered the options of tightening and loosening policy, but inflation concerns were an important factor.

Sterling gained firm relief following the minutes and advanced strongly to a high above 1.5650 against the dollar. Underlying confidence surrounding the UK economy is still fragile on fears over a slowdown in spending and Sterling retreated back towards 1.56 later in the session.

Underlying risk appetite is also still fragile which is limiting global-based interest in Sterling. The retail sales and government borrowing data will be watched closely on Thursday and a higher than expected budget deficit would undermine the currency through renewed unease over the structural outlook.

Swiss franc

The dollar found further support below 1.04 against the franc on Wednesday, but was unable to make any serious headway and was blocked below 1.0450 as ranges narrowed during the session. Although initially holding its ground, the Euro was unable to make an attack on resistance towards 1.35 and retreated back to the 1.34 area.

Sovereign debt fears will continue to be an important market focus and the Swiss currency will continue to gain defensive support on fears that a series of major economies will be at risk of losing their AAA credit ratings in the medium term.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

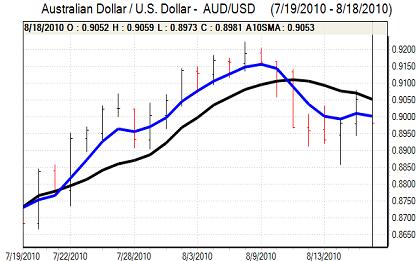

Australian dollar

After peaking close to the 0.9080 level against the US dollar in US trading on Tuesday, the Australian currency was unable to make further progress on Wednesday and gradually retreated to test support just below 0.90.

Major global bourses were generally subdued which curbed risk appetite to some extent and there were persistent fears surrounding the global economy which limited currency support. There was a further daily increase in global freight rates which served to keep selling pressure at bay.