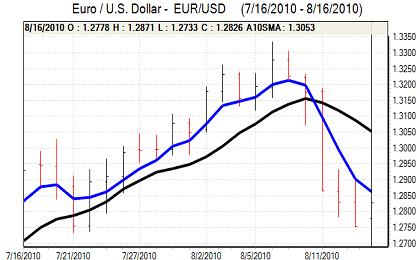

EUR/USD

The Euro found technical support below 1.2750 against the dollar in Asian trading on Monday before a recovery to the 1.2790 area as the US currency retreated from over-bought levels.

The latest capital inflows was slightly stronger than expected with net long-term inflows of US$44.4bn for June. There were, however, reports that the Chinese authorities were more attracted to Euro-zone bonds rather than US bonds which will raise some doubts over longer-term trends.

The New York manufacturing index was slightly weaker than expected, although there was a small increase to 7.1 for August from 5.1 the previous month. The NAHB housing index was again weaker than expected with a decline to a 17-month low of 13 for July from 14 the previous month, maintaining the run of weak housing-related data. The latest starts and permits data will be watched closely on Tuesday to assess the underlying outlook. Although the latest Federal Reserve loan survey suggested a slight easing of credit standards, underlying doubts will persist.

There was a stabilisation in risk appetite later in the day which helped curb dollar buying. The Euro also gained support from the fact that there was only limited ECB buying of Euro-zone bonds in the latest week and the Euro pushed to a high around 1.2870. There were still structural doubts surrounding the Euro-zone as yield spreads continued to widen and there was a retreat back to the 1.2825 area later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The latest Japanese GDP data was weaker than expected with a 0.1% advance compared with expectations of around 0.6%. The data reinforced a mood of caution surrounding the Japanese and global economy which triggered renewed defensive demand for the yen. The data, however, will also increase fears over Japanese demand conditions and there will be additional pressure for yen gains to be capped. In this environment, there will be further speculation over intervention to weaken the Japanese currency, especially with meetings between the Bank of Japan and Finance Ministry this week.

The dollar weakened back to below the 86 level on fading risk appetite. The number of long speculative yen positions is at a 8-month high according to the latest data which may limit the potential for further buying support.

There was still a further gradual erosion of the dollar during the day, especially as the yield on US 10-year bonds weakened to the lowest level since March 2009 and the dollar dipped to a low near 85.20.

Sterling

The latest Rightmove housing data was weaker than expected with a 1.7% decline in prices for August which will tend to maintain doubts over the UK housing sector. Sterling again found support close to 1.5550 against the dollar on Monday with the cautious tone surrounding risk appetite curbing the scope for gains.

Sterling continued to find support near 1.5550 and there was a rally to a peak of 1.57 on a covering of short positions before consolidation near 1.5660 as the UK currency strengthened through 0.82 against the Euro.

The latest inflation data will be watched closely on Tuesday and a higher than expected reading would increase pressure for the Bank of England to take a more aggressive stance on interest rates, although there will certainly be scepticism whether there will be a policy shift. In this environment, the central bank minutes will also be watched very closely on Wednesday to see whether Sentence was able to convince any more MPC members to back a rate increase.

Swiss franc

The dollar remained on the defensive against the franc during the day and retreated to a low close to 1.0350 before recovering to the 1.04 area later in the US session. The Euro remained under pressure against the Swiss currency for much of the day with a six-week trough close to 1.3270 before a recovery back to above the 1.33 level.

The Swiss currency continued to gain support on defensive grounds as doubts over the global economy persisted. The franc also gained support from persistent doubts over the Euro-zone structural vulnerabilities.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

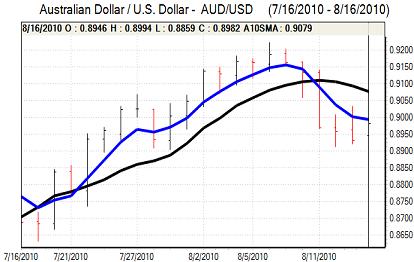

Australian dollar

The Australian dollar weakened to a low close to 0.8850 against the US dollar on Monday before finding support. After an initial correction back to the 0.89 region, there was a further rally to the 0.8980 area as there was a general easing of dollar buying.

Confidence surrounding the global and domestic economy is liable to remain weaker in the short term due to fears over slower growth and this will tend to limit Australian dollar buying support, especially if commodity prices are subjected to renewed selling pressure.