EUR/USD

The Euro found support below 1.48 against the dollar during Monday and rallied firmly during the European session with a peak at the 1.49 level as the US currency also tested 3-year lows on a trade-weighted index.

The latest US PMI manufacturing data was slightly stronger than expected at 60.4 for April from 61.2 the previous month and continued to indicate that the industrial sector is being supported by a weaker US dollar. There was another strong reading for the employment component which will maintain optimism surrounding manufacturing payrolls in Friday’s data. The latest construction spending data was also stronger than expected, although this is subject to considerable revision.

The Euro-zone PMI data confirmed solid growth in the sector, but there will be continuing fears over divergence in the sector as there was a further contraction in Greek activity. The ECB has maintained a slightly more cautious tone on interest rates with Vice-President Constancio stating that the ECB had not decided to rush into a planned series of rate increases.

Euro-group head Juncker stated that the level of the Euro was not yet a concern and that strength primarily resulted from a weak dollar. The comments dampened any immediate speculation over more aggressive Euro-zone rhetoric to weaken the Euro.

The dollar did find relief from later in the US session and the Euro retreated back to test support below 1.48 as risk appetite was more cautious. There were concerns that Osama bin Laden’s death would trigger retaliatory attacks by al-Qaeda which unsettled markets and curbed dollar selling, but the Euro found renewed support below 1.48.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was again blocked in the 81.70 area against the yen during Monday and retreated to test support just below 81.00 in Asian trading on Tuesday.

Risk conditions remained generally more cautious, especially with further high volatility in commodities and there was greater caution over selling the Japanese currency. The dollar was unable to gain any support on yield grounds as US Treasury yields were slightly lower during the day.

There were further reports of semi-official dollar buying close to the 81 level and this buying may have a greater impact that usual given the succession of Japanese market holidays with Tokyo closed on Tuesday.

Sterling

Sterling found support close to 1.6650 against the dollar in European trading on Tuesday and rallied to a high at 1.6720 as the US currency came under wider selling pressure. Market conditions were generally choppy, especially with UK markets closed for a holiday and Sterling weakened sharply from late in the US session with lows below 1.66 as risk appetite deteriorated.

The manufacturing PMI data on Tuesday may have a significant near-term impact on the currency, especially if it’s a weaker than expected reading, although the impact on Bank of England policies may be limited.

In comments on Monday, Bank of England Governor King stated that there were still very important vulnerabilities within the European economy and that higher interest rates could be damaging given the extent of the debt burden.

There will be further expectations that the Bank of England will leave interest rates on hold at 0.50% at the Thursday MPC interest-rate decision which will curb near-term yield support for Sterling as it consolidated just weaker than 0.89 against the Euro.

Swiss franc

The dollar was capped near 0.87 against the Swiss franc during Monday and retreated back towards record lows with a low point near 0.8630 as the franc gained fresh support on the crosses.

As far as the Swiss economic data is concerned, there was a decline in the PMI index to 58.4 for April from 59.3 and the latest retail sales report was also slightly weaker than expected. There will be some speculation that economic momentum is slowing, but the immediate market impact is likely to be limited as the franc continues to gain support on safe-haven grounds.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

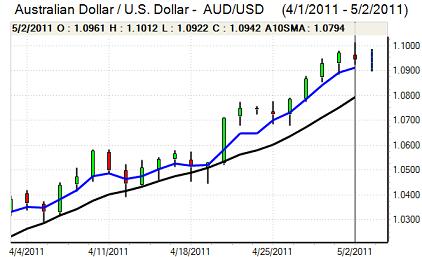

The Australian dollar again challenged the 1.10 level against the US dollar during the New York session on Monday, but there was further tough resistance at this level and the currency retreated to test support below 1.09 as there was a more cautious attitude towards risk appetite as equity markets retreated.

As expected, the Reserve Bank of Australia held interest rates at 4.75% following the latest monetary meeting. The bank was optimistic that inflation would be close to target over the next year and that policy was appropriate. The comments were slightly more dovish than expected which curbed demand for the currency to some extent despite solid buying support on dips.