EUR/USD

The Euro was unable to break above the 1.3070 area against the dollar on Wednesday and was then subjected to sustained selling pressure as underlying sentiment remained fragile.

A renewed increase in borrowing from the ECB and a record level of over-night deposits at above EUR450bn undermined confidence in the banking sector and a badly-received rights issue at a very steep discount for Italian bank Unicredit also had a negative impact as its share price weakened by close to 50%. There were further concerns over the Spanish economy with speculation that the country would need to draw on IMF support, especially with regional debt fears. There was a significant widening of Spanish yield spreads during the day which undermined Euro confidence.

The latest German bond auction was more successful that the previous uncovered one, but underlying demand remained weak and there were further major concerns surrounding first-quarter debt issuance requirements within the Euro-zone as a whole.

As far as data releases were concerned, there was a small upward revision to the PMI services-sector data while the flash consumer headline rate declined to 2.8% for December from 3.0%. There will be further pressure on the ECB to take a more aggressive stance on monetary policy and there will also be continuing criticism of what the market sees as covert quantitative easing. The Euro will be sapped by a lack of yield support and expectations of further action by the central bank, especially as there will be speculation that the new board composition will be more dovish.

There were no major US data releases with a slightly smaller than expected increase in factory orders while vehicle sales were broadly within expectations and the Euro dipped sharply to test support in the 1.29 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained trapped on the defensive against the yen during Wednesday and dipped to lows near 76.60, although the main feature was a continuation of very narrow ranges. The main focus was again on the crosses as the Euro tested fresh 11-year lows near 99.0.

The yen has proved resilient over the past few days even when there has been an improvement in risk appetite which does suggest underlying demand for the currency as confidence in the global economy remains extremely fragile.

From a medium-term perspective, there is still a high degree of unease surrounding the fundamentals as Japan’s debt burden continues to increase. For now, these fears can still have a positive yen influence as institutions are more likely to repatriate funds to boost domestic reserve ratios.

Sterling

Sterling was unable to hold above 1.5650 against the dollar on Wednesday, but the performance was still resilient. The construction PMI index was higher than expected with an increase to 53.2 for December from 52.3 previously and again the favourable weather conditions will have had a significant impact as projects were able to continue throughout the winter. In this context, underlying confidence was still very fragile.

There was an increase in mortgage approvals to a six-month high while consumer lending remained subdued. There was a further decline in money supply for the month and the very weak rate of monetary expansion will maintain fears over the 2012 economic outlook as well as maintaining pressure for the Bank of England to engage in further quantitative easing. Overall confidence in the economy is likely to remain weak.

There was a strong increase in reported overseas holdings of UK bonds which matches the evidence of substantial buying as a defensive play against Euro-zone turbulence.

Swiss franc

The dollar found support in the 0.93 area against the franc on Wednesday and pushed to highs near 0.9450 before losing momentum. Although unable to break above the 1.22 level, the Euro was broadly resilient against the Swiss currency.

The continuing media focus surrounding the wife of National Bank President Hildebrand and currency transactions was the main focus with the bank set to hold a press conference on Thursday to clarify the situation. There is the potential for short-term selling pressure on the currency if Hildebrand is forced to resign. There will be speculation that the bank will also find it very difficult to amend the minimum Euro level while he remains in office.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

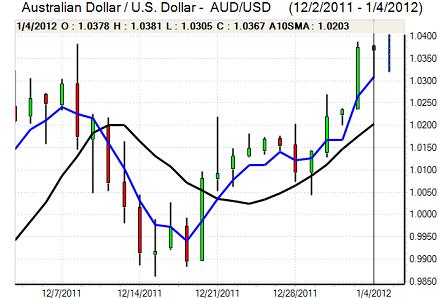

Australian dollar

The Australian dollar found support near the 1.03 level against the US dollar and rallied again late in the US session with a peak again near 1.0370 as the currency tested record highs against the Euro.

The trade account was slightly weaker than expected with the surplus for November dipping to AUD1.35bn from a revised AUD1.42bn previously. The immediate impact should be limited, but there will be some concerns over the export outlook.

Wider doubts over the Asian economy and unease over the banking sector triggered a move back to the 1.03 area in choppy trading in Asia on Thursday.