EUR/USD

The Euro found support close to 1.3860 against the dollar in European trading on Wednesday and rallied to the 1.3930 area, but it was unable to gain any significant traction and weakened back towards support levels later in the session.

The Euro received an initial boost after reports that the ECB was buying European peripheral government bonds which calmed market nerves. The impact was short lived as Portuguese bond yields rose sharply in the latest auction. Benchmark Portuguese yield spreads relative to German bunds also rose to record levels which also had a negative impact on wider confidence.

Political negotiations surrounding the EU support mechanisms will continue to be watched closely with the EU summit this Friday followed by the larger meeting on March 24th and 25th where leaders are looking to finalise a deal. Any sign of discord would tend to increase Euro vulnerability. There were also fears that any increase in ECB interest rates would exacerbate debt difficulties within the peripheral economies.

With little in the way of US data over the first three days of this week, the latest jobless claims data will be watched closely on Thursday. Another decline in claims would increase speculation that the Federal Reserve will decide against any further quantitative easing which would also tend to support the dollar.

Risk conditions will remain important and the US currency has been unsettled by a renewed increase in oil prices. The dollar would, however, tend to benefit if there was a wider flow of funds out of emerging markets and volatility is liable to increase. The Euro was close to 1.3860 support in Asia on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar maintained a firm tone during Wednesday as sentiment remained stronger, but it was unable to break above resistance near 83.0 and drifted back towards 82.60 before finding fresh buying support.

A small downward revision to the fourth-quarter Japanese GDP data did not have a major impact while the reported Chinese trade deficit had a small impact in dampening risk appetite.

The dollar continued to gain support on yield grounds with a further increase in benchmark Treasury yields as optimism surrounding US growth prospects continued. There will continue to be capital repatriation in the near term and exporter selling will also be a feature which will still make it difficult for the US currency to make strong headway.

Sterling

Sterling had a firmer tone in European trading on Wednesday and, after finding support close to 1.6150, it rallied to a high near 1.6230 before retreating again.

The latest trade data was better than expected with a decline in the goods deficit to GBP7.1bn for January from a revised GBP9.7bn the previous month. The data is likely to have been affected by weather conditions with exports delayed from December helping to boost January shipments.

Monetary policy will remain the dominant short-term focus with the Bank of England interest rate decision due on Thursday. There is certainly likely to be a very close decision and another split vote. Markets are expecting the MPC to wait for further evidence on the economy before making a move and any decision to raise rates would lead to a spike higher in Sterling. Overall confidence in the economy is liable to remain fragile which could trigger a rapid reversal and the UK currency drifted back towards 1.6150 in Asian trading on Thursday.

Swiss franc

The dollar was blocked near 0.9370 against the franc on Wednesday and dipped sharply weaker to lows near 0.9270 before regaining the 0.93 level in choppy trading. Initial dollar losses were compounded by a generally stronger Swiss currency as risk appetite deteriorated again with an increase in Libyan fighting putting fresh upward pressure on crude-oil prices.

The Swiss currency also gained renewed support against the Euro as Euro-zone debt concerns increased again with a widening of peripheral spreads. The latest Swiss consumer inflation data was broadly in line with market expectations and did not have a major impact.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

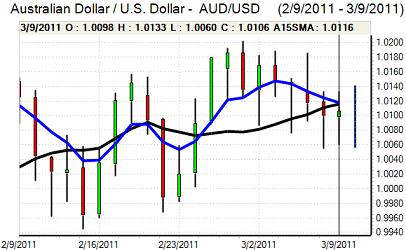

Australian dollar

The Australian dollar hit resistance close to1.0120 against the US currency during Wednesday and retreated to test support below the 1.01 level before dipping lower again in local trading on Thursday.

The currency was unsettled by a weaker trend in risk appetite and the latest employment data was weaker than expected with a 10,100 decline in employment for February. The data is likely to have been distorted by the flood impact, but underlying confidence in the economy is liable to be slightly weaker. Any evidence that high energy prices is starting to undermine the regional economy would also undermine confidence and the currency tested support below 1.0050 late in the Asian session on Thursday.