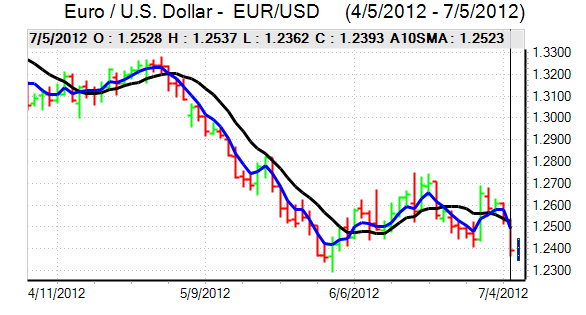

EUR/USD

The Euro was unable to make any headway against the dollar ahead of key economic events on Thursday and drifted weaker to the 1.25 area. There was a rise in Spanish yields at the latest 10-year bond auction and there was also a sharp rise in benchmark market yields even though there was a decline in shorter-term yields. The Spanish government announced that further budget cuts would be required to meet targets, reinforcing fears over a recessionary spiral while Greece admitted that there would be difficulties in meeting the troika targets.

The ECB cut the benchmark refinancing rate by 0.25% to a record low of 0.75% which was in line with market expectations while the deposit rate was cut to zero. In the press conference following the meeting, Bank President Draghi stated that downside risks to the economy were in the process of materialising and he remained generally downbeat surrounding the outlook. He also downplayed the prospect of non-conventional measures and denied that the bank was running out of conventional options.

The comments overall increased unease surrounding the structural outlook and a lack of policy options which undermined the Euro. Draghi also issued thinly-veiled warnings over the Spanish banking sector which reinforced the increase in Spanish yields and undermined market sentiment with fears that Spain could not be recued within the Euro area.

The latest US employment data was stronger than expected with a decline in jobless claims to 374,000 in the latest week from 386,000 previously while the latest ADP report was also stronger than expected at 176,000 in the latest week. In contrast, there was a decline in the non-manufacturing PMI index to 52.1 from 53.7 previously which maintained doubts surrounding the US outlook. A weak payroll report would reinforce speculation over additional Fed policy action.

There was a brief surge in risk appetite following another Chinese interest rate cut, but the US dollar recovered from an initial dip. The Euro remained on the defensive and weakened to one-month lows near 1.2375 before consolidating ahead of the payroll release.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips towards the 79.50 level against the yen on Thursday and pushed sharply higher to a peak just above the 80 level before hitting resistance.

The dollar gained ground following the latest US employment data and there was also a recovery in risk appetite following the Chinese interest rate cut. There was still evidence of exporter selling near the 80 level which held the US currency back.

Comments from Bank of Japan officials suggested that there would be no additional monetary easing at next week’s policy meeting. Asian equity markets were generally fragile in Friday’s trading which curbed any further boost to risk appetite and the US dollar was again blocked in the 80 area.

Sterling

Sterling hit resistance above 1.56 against the dollar during Thursday and dipped weaker to lows near 1.55. Moves were cushioned by moves in the Euro as the UK currency strengthened to five-week highs beyond 0.80.

The Bank of England left interest rates on hold at 0.50% following the latest Monetary Policy Meeting and also announced an increase in the quantitative easing amount by a further GBP50bn to GBP375bn. In justifying further action, the bank stated that output was estimated to have contracted for the past two quarters while exports had deteriorated.

The move was broadly in line with market expectations, but there had been some speculation that the bank could announce an additional GBP75bn in easing which lessened selling pressure on Sterling. There will still be a high degree of unease surrounding the economic outlook and expectations of medium-term currency vulnerability.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

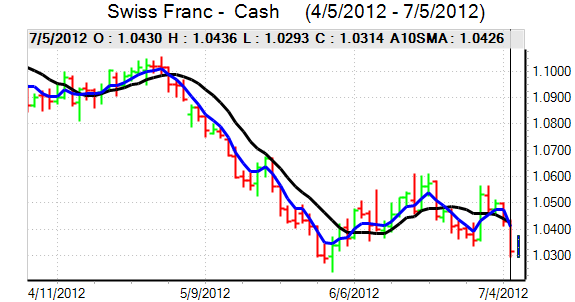

Swiss franc

The dollar found support just below 0.96 against the franc in Europe on Thursday and advanced sharply to a peak above the 0.97 level before stabilising at higher levels. For the second day running, there was a brief spike lower in the Euro to a low just below the 1.20 minimum level before a move back to the 1.2010 region which strongly suggested that the National Bank was intervening to weaken the Swiss franc.

The Euro’s yield advantage over the franc has been weakened further which may increase capital flows out of the Euro, although structural considerations are liable to dominate in the short term.

Australian dollar

The Australian dollar initially found support close to 1.0250 against the US dollar on Thursday and pushed sharply higher to a peak above 1.03 following the Chinese central bank move to cut interest rates. The currency was unable to sustain the gains and briefly weakened back to below 1.0250 before regaining ground.

The currency maintained a strong tone on the crosses as it was at record highs against the Euro. There will still be major concerns surrounding the global growth outlook and this was again an important factor in curbing demand for the Australian currency in Asian trading on Friday.