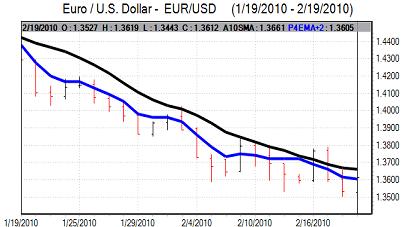

EUR/USD

The Euro found support close to 1.3450 against the dollar on Friday and then rebounded firmly during the day. There was evidence of short covering following sharp losses over the previous 24 hours with the Euro also recovering after testing important medium-term support levels.

Following the surprise Federal Reserve discount rate increase the previous day, central bank officials were again keen to emphasise that this was not a change in monetary policy and there were also suggestions that there would be no short-term move to increase the Fed funds rate which curbed any further dollar demand on yield grounds. Underlying confidence in a US recovery is still firm at this stage which is providing background dollar support.

The latest US inflation data was also weaker than expected, particularly the core rate with underlying prices recording a 0.1% decline for the month compared with expectations of a 0.2% increase. The tame inflation data further dampened any expectations of a near-term tightening by the Fed. Chairman Bernanke’s comments will inevitably be watched very closely this week for any further hints on the timing of a rate increase.

The Euro recovered to a high above 1.3640 in Asian trading on Monday, gaining further support from speculation over a further support package for Greece. Underlying Euro confidence is still weak with strong option-related demand for puts and this will make it difficult for the Euro to secure a sustained recovery.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar challenged highs just above 92 against the yen following the Fed’s discount rate hike and resistance in this region came under further attack on Friday, but the US currency was unable to make a break and drifted slightly weaker with a test of support below 91.50.

Underlying risk appetite remains generally slightly stronger and this has dampened demand for the yen on defensive grounds with the Euro challenging 3-week highs near 125 against the Japanese currency.

The Bank of Japan is also maintaining a highly expansionary monetary policy which is limiting support for the yen on yield grounds, especially with increased speculation that the US Federal Reserve will move towards a tighter policy and the dollar held firm in Asian trading on Monday.

Sterling

Sterling confidence remained weak following the government-borrowing data on Thursday and the currency was subjected to further selling pressure in Europe on Friday.

The latest UK retail sales data was significantly weaker than expected with a monthly 1.8% decline compared with expectations of a 0.5% fall. The data is likely to have been distorted by tax changes and poor weather during the month, but there was still increased fear over a renewed downturn in the economy which depressed Sterling.

Underlying confidence also remains very weak on structural grounds as government borrowing levels remain a serious market issue. There will be the risk of further selling pressure on the currency if speculation over a credit-rating downgrade intensifies.

Sterling weakened to a fresh 9-month low near 1.5350 against the dollar, but then found support from a general unwinding of long dollar positions and moved back to near 1.5450 later in the session. The UK currency was still generally weaker on the crosses and dipped to 0.88 against the Euro on Monday.

Swiss franc

The dollar peaked near 1.0880 against the franc on Friday before a retreat back to the 1.08 area, in line with a general retreat for the US currency. The Euro was unable to make any headway during the day and consolidated close to the 1.5650 region.

Markets remained wary over the potential for National Bank intervention and were unwilling to chase the Euro substantially weaker, but underlying demand for the currency remained extremely fragile given persistent fears over the Euro-zone structural vulnerabilities.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

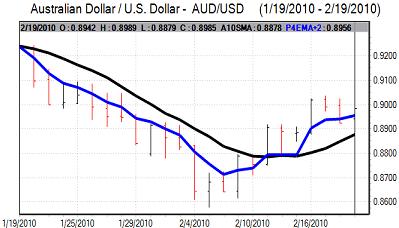

Australian dollar

From highs near 0.90, the Australian dollar weakened to test support below 0.89 against the US currency during Friday. There was firm support below this level and there were renewed gains later in the US session.

With the US dollar generally weaker and risk appetite generally on a firmer footing, the Australian dollar re-tested resistance levels just above the 0.90 level on Friday.