February hogs closed up $0.72 at $65.43. February hogs gapped up and closed above the 10-day moving average crossing at 65.35 on Tuesday as it consolidated some of last Thursday’s decline. The high-range close sets the stage for a steady to higher opening on Wednesday. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends last Thursday’s decline, the August-October uptrend line crossing near 62.61 is the next downside target. Closes above the 20-day moving average crossing at 65.63 are needed to confirm that a short-term low has been posted. First resistance is the 20-day moving average crossing at 65.63. Second resistance is the reaction high crossing at 65.70. First support is last Thursday’s low crossing at 63.70. Second support is the August-October uptrend line crossing near 62.75.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

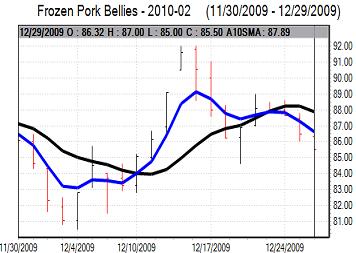

February bellies closed down $1.00 at $85.50. February bellies closed lower on Tuesday and below the 20-day moving average as it consolidates some of last week’s rally. The low-range close sets the stage for a steady to lower opening on Wednesday. Stochastics and the RSI are turning bearish signaling that sideways to lower prices are possible near-term. If February renews the decline off this month’s high, the reaction low crossing at 82.80 is the next downside target. Closes above the 10-day moving average crossing at 87.89 would confirm that a short-term lowhas been posted. First resistance is the 10-day moving average crossing at 87.89. Second resistance is last Tuesday’s high crossing at 88.70. First support is today’s low crossing at 85.50. Second support is last Monday’s low crossing at 84.60.

February cattle closed down $0.25 at 85.13. February cattle closed lower on Tuesday as it consolidated some of Monday’s rally. The mid-range close sets the stage for a steady opening on Wednesday. Stochastics and the RSI remain neutral to bullish signaling that sideways to higher prices are possible near-term. If February extends this month’s rally, the reaction high crossing at 86.00 is the next upside target. Closes below the 20-day moving average crossing at 84.15 are needed to confirm that a short-term top has been posted. First resistance is last Tuesday’s high crossing at 85.85. Second resistance is the reaction high crossing at 86.00. First support is the 10-day moving average crossing at 85.01. Second support is the 20-day moving average crossing at 84.15.

March feeder cattle closed down $0.23 at $94.72. March Feeder cattle posted an inside day with a lower close on Tuesday as it extends the trading range of the past seven days. The mid-range close sets the stage for a steady opening on Wednesday. Stochastics and the RSI remain neutral to bullish signaling that sideways to higher prices are possible near-term. If March renews this month’s rally, the November 11th gap crossing at 95.50 is the next upside target. Closes below the 20-day moving average crossing at 93.72 are needed to confirm that a short-term top has been posted. First resistance is last Monday’s high crossing at 95.25. Second resistance is the November 11th gap crossing at 95.50. First support

is the 20-day moving average crossing at 93.72. Second support is the reaction low crossing at 92.65.