October live cattle closed down $0.40 at $89.82 yesterday. Prices closed near mid-range. The key “outside markets” were mostly bearish for cattle futures yesterday, crude oil prices were sharply lower and the U.S. dollar was firmer. Lingering U.S. economic worries also weighed on the cattle futures market yesterday. Prices are still in a two-week-old uptrend on the daily bar chart. A bullish pennant pattern may be forming on the daily chart. Bulls’ next upside price objective is to push and close prices above solid technical resistance at last week’s high of $90.80. The next downside technical objective for the bears is pushing and closing prices below solid technical support at $87.45. First resistance is seen at yesterday’s high of $90.15 and then at $90.50. First support is seen at yesterday’s low of $89.45 and then at $89.00.

Wyckoff’s Market Rating: 6.0.

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

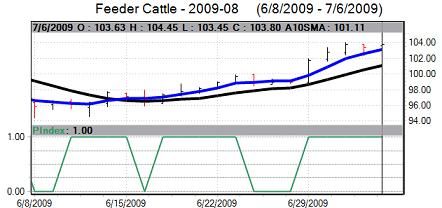

August feeder cattle closed up $0.35 at $103.80 yesterday. Prices closed nearer the session low after hitting a fresh nine-month high early on yesterday. The bulls still have the solid near-term technical advantage. Prices are in a steep four-week-old uptrend on the daily bar chart. The next upside price objective for the feeder bulls is to push prices above solid technical resistance at $106.00. The next downside price objective for the bears is to push prices below solid technical support at $100.00. First resistance is seen at $104.00 and then at yesterday’s high of $104.45. First support is seen at yesterday’s low of $103.45 and then at $103.00.

Wyckoff’s Market Rating: 7.5

October lean hogs closed up $0.77 at $57.95 at midday yesterday. Prices closed near mid-range yesterday and hit a fresh two-week high on short covering in a bear market. Prices are still in a seven-month-old downtrend on the daily bar chart. The hog bears still have the near-term technical advantage. However, bulls have recently gained some fresh upside near-term technical momentum, but need to show more power soon. The next upside price objective for the bulls is to push prices above solid chart resistance at $60.00. The next downside price objective for the bears is pushing and closing prices below solid technical support at $56.00. First resistance is seen at yesterday’s high of $58.40 and then at $59.00. First support is seen at yesterday’s low of $57.20 and then at $57.00.

Wyckoff’s Market Rating: 3.0

August pork bellies closed up $1.35 at $55.25 yesterday. Prices closed near the session high on short covering in a bear market. Bears still have the solid near-term technical advantage. The next upside price objective for the bulls is pushing and closing prices above solid technical resistance at last week’s high of $59.40. The next downside price objective for the bears is pushing and closing prices below solid technical support at $50.00. First resistance is seen at $56.00 and then at $57.00. First support is seen at $55.00 and then at $54.00.

Wyckoff’s Market Rating: 2.0