October live cattle closed up $1.65 at $90.30 yesterday. Prices closed near the session high yesterday on fresh speculative buying. Bulls yesterday regained fresh upside near-term technical momentum. Yesterday’s boxed beef movement was reported by USDA to be a solid 125 boxes. However, cutout prices were mixed, with choice cuts up 17 cents and select cuts down $1.25. The key “outside markets” were mostly bullish for cattle futures yesterday. While crude oil prices were weaker, stock indexes were higher and the U.S. dollar was weaker. Bulls have the near-term technical advantage in the cattle futures market. The price uptrend from the June lows has now been re-established. Bulls’ next upside price objective is to push and close prices above solid technical resistance at the July high of $90.80. The next downside technical objective for the bears is pushing and closing prices below solid technical support at $88.00. First resistance is seen at yesterday’s high of $90.45 and then at $90.80. First support is seen at $90.00 and then at $89.60.

Wyckoff‘s Market Rating: 6.0.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

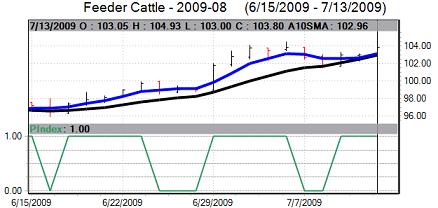

August feeder cattle closed up $0.82 at $103.75 yesterday. Prices closed near mid-range but did hit a fresh 9.5-month high yesterday. The feeders were supported by more losses in the corn futures market. The feeder cattle bulls have the overall near-term technical advantage and gained some more upside momentum yesterday. Prices are still in a five-week-old uptrend on the daily bar chart. The next upside price objective for the feeder bulls is to push prices above solid technical resistance at $106.00. The next downside price objective for the bears is to push prices below solid technical support at last week’s low of $101.50. First resistance is seen at last week’s high of $104.45 and then at yesterday’s high of $104.90. First support is seen at yesterday’s low of $103.00 and then at $102.50.

Wyckoff‘s Market Rating: 7.0

October lean hogs closed up $0.15 at $58.80 yesterday. Prices closed nearer the session low and were supported by tepid short covering in a bear market. The key “outside markets” were mostly bullish for hog futures yesterday. While crude oil prices were weaker, stock indexes were higher and the U.S. dollar was weaker. Cash hog prices were steady to weaker yesterday, and that limited buying interest in the futures. Cash hogs are called to trade steady to weaker again on Tuesday. There were some hog plants closed in the Midwest yesterday, due to packer worries about profit margins. That also limited the upside in hog futures. October hog futures prices are still in a seven-month-old downtrend on the daily bar chart. The hog bears still have the near-term technical advantage. The next upside price objective for the bulls is to push prices above solid chart resistance at $60.00. The next downside price objective for the bears is pushing and closing prices below solid technical support at $56.00. First resistance is seen at yesterday’s high of $59.55 and

then at $60.00. First support is seen at yesterday’s low of $58.35 and then at $58.00.

Wyckoff‘s Market Rating: 3.0

August pork bellies closed up $0.50 at $62.50 yesterday. Prices closed near the session low yesterday after hitting a fresh three-week high early on. More short covering was featured. Prices have made a good recovery from the early-July contract low and a market low does appear to be in place. Bears do still have the slight overall near-term technical advantage. The next upside price objective for the bulls is pushing and closing prices above solid technical resistance at $65.00. The next downside price objective for the bears is pushing and closing prices below solid technical support at $57.50. First resistance is seen at $63.00 and then at yesterday’s high of $64.00. First support is seen at yesterday’s low of $62.50 and then at $62.00.

Wyckoff’s Market Rating: 4.5