June live cattle closed down $0.67 at $94.07 yesterday. Prices closed near the session low yesterday on more profit-taking pressure. The cattle market bulls still have the overall near-term technical advantage. Prices are in a four-month-old uptrend on the daily bar chart. Bulls’ next upside price objective is to push and close prices above solid technical resistance at the contract high of $96.22. The next downside technical objective for the bears is pushing and closing prices below solid technical support at $92.50. First resistance is seen at $94.50 and then at $95.00. First support is seen at yesterday’s low of $94.00 and then at $93.42.

Wyckoff’s Market Rating: 7.0.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

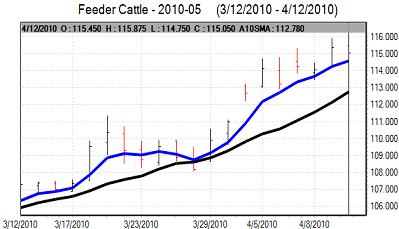

May feeder cattle closed down $0.45 at $114.92 yesterday. Prices closed near the session low yesterday and saw mild profit taking. Feeder bulls still have the solid near- term technical advantage. Prices are in a four-month-old uptrend on the daily bar chart. The next upside price objective for the feeder bulls is to push and close prices above solid technical resistance at $117.50. The next downside price objective for the bears is to push and close prices below solid technical support at $111.30. First resistance is seen at Friday’s contract high of $115.80 and then at $116.00. First support is seen at $114.30 and then at $114.00.

Wyckoff’s Market Rating: 8.0

June lean hogs closed down $0.40 at $83.97 yesterday. Prices closed nearer the session low yesterday on profit-taking pressure. Bulls still have the solid upside near-term technical advantage as prices hover near the recent contract high. Prices are in a 2.5-month-old uptrend on the daily bar chart. The next upside price objective for the bulls is to push prices above solid chart resistance at the contract high of $85.90. The next downside price objective for the bears is pushing and closing prices below solid technical support at $82.15. First resistance is seen at yesterday’s high of $84.50 and then at $85.00.First support is seen at yesterday’s low of $83.70 and then at $83.50.

Wyckoff’s Market Rating: 7.5

May pork bellies closed down $2.62 at $93.65 yesterday. Prices closed nearer the session low yesterday and hit a fresh three-week low. Some chart damage occurred yesterday and more would occur if there is good follow-through selling pressure on Tuesday. A two-month-old uptrend on the daily bar chart was negated yesterday. The next upside price objective for the bulls is pushing and closing prices above solid technical resistance at the contract high of $99.30. The next downside price objective for the bears is pushing and closing prices below solid technical support at the March low of $90.40. First resistance is seen at $94.00 and then at $95.00. First support is seen at yesterday’s low of $93.30 and then at $92.50.

Wyckoff’s Market Rating: 6.5