April live cattle closed down the $3.00 limit at $113.50 yesterday. Prices gapped lower on the daily bar chart and saw strong selling pressure on demand concerns amid the crisis in Japan. Japan is a major U.S. meat importer. The general sell off in other commodity markets also pressured the cattle market yesterday. No serious chart damage was inflicted yesterday, but good follow-through selling pressure on Wednesday would likely produce some near-term chart damage. The cattle market bulls still have the overall near-term technical advantage. Cattle market bulls’ next upside price breakout objective is to push prices above solid technical resistance at $116.45, which is the top of yesterday’s big downside price gap on the daily bar chart. The next downside technical breakout objective for the bears is pushing prices below solid technical support at the March low of $111.05. First resistance is seen at $114.00 and then at yesterday’s high of $114.70. First support is seen at $113.00 and then at $112.50.

Wyckoff’s Market Rating: 7.0

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

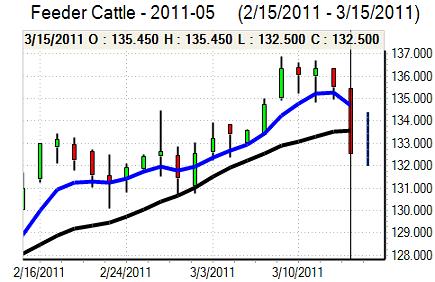

May feeder cattle closed down the $3.00 limit at $132.50 yesterday. Prices gapped lower on the daily bar chart and hit a fresh two-week low yesterday. No serious chart damage occurred yesterday, but good follow-through selling pressure on Wednesday would likely produce chart damage. Bulls still have the overall technical advantage. The next upside price breakout objective for the feeder bulls is to push and close prices above solid technical resistance at $135.05, which is the top of yesterday’s big downside price gap on the daily bar chart. The next downside price breakout objective for the bears is to push and close prices below solid technical support at the March low of $130.72. First resistance is seen at $133.00 and then at yesterday’s high of $133.40. First support is seen at $132.00 and then at $131.50.

Wyckoff’s Market Rating: 7.0

April lean hogs closed down $1.00 at $84.95 yesterday. Prices again gapped lower on the daily bar chart and hit a fresh two-month low yesterday. Prices did close nearer the session high yesterday. The hog market has also reacted negatively to the Japan disaster and its implications on demand for pork from Japan. Fresh technical damage in hogs has been inflicted this week. Bears have the near-term technical advantage. The next upside price breakout objective for the bulls is to push and close prices above solid chart resistance at $87.85, which is the top of Monday’s downside price gap on the daily bar chart. The next downside price breakout objective for the bears is pushing and closing prices below solid technical support at $84.00. First resistance is seen at $85.45 and then at $86.00. First support is seen at yesterday’s low of $84.35 and then at $84.00.

Wyckoff’s Market Rating: 3.5