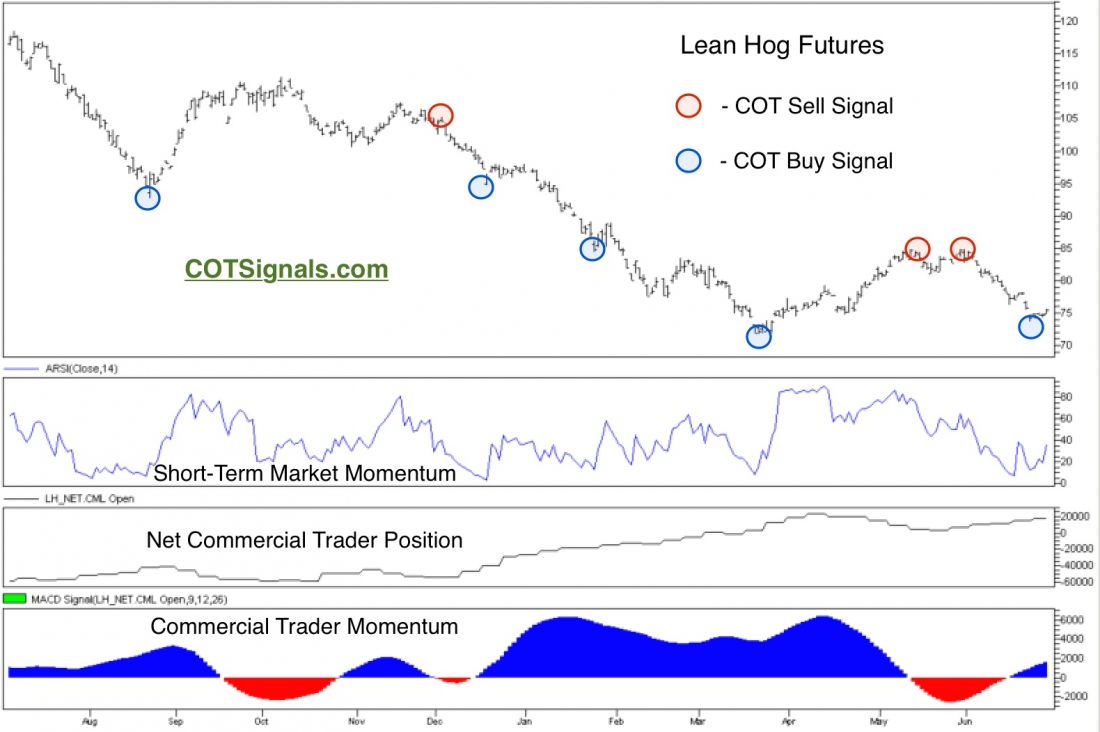

The hog market, like many commodities, has been in a downward trend since making major highs last fall. In fact, the recent decline in commodity prices has begun to feed on itself as lower input costs like feed, fuel and fertilizer are leading to lower prices for finished products. When this is combined with tepid economic growth, consumers retreat further fueling the downward spiral that is becoming synonymous with the commodity markets. However, like the grain markets we wrote about last week, current lean hog prices have retreated to their long-term value and basing area near $75 and are once again attracting a strong commercial bid.

The March low near $72 was the lowest this market had been since May of 2012. There have been four other major lows created over the last six years in the same general price band. Each of the previous declines was met with significant commercial trader buying as packers sought to maximize their input price advantage at these levels. Their buying supported the market and helped turn each of the recent major bottoms. It’s no surprise then that commercial traders’ largest recent position coincided with the May of 2012 low.

The current situation is very similar to what we’ve seen on previous declines. Commercial traders have been net buyers in the lean hog futures for five straight weeks. This has been crucial as the market is defending its March low and attempting to turn higher. We’ve plotted the trades this methodology has produced on the following chart. No method is foolproof. The most important thing is, “Always control your losses.” Each of the plotted trades was risked only to the respective swing high or low that coincided with the move. Due to the expiration of the nearby July contract, the trade should be executed in the August contract with a protective sell stop placed at last week’s low of $71.175.

For more professional market analyisis, click here