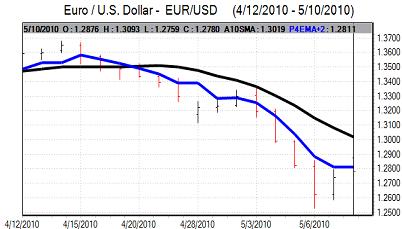

EUR/USD

Over the weekend, EU leaders agreed a support fund totalling EUR750bn in order to stabilise Euro-zone and Euro confidence. The bulk of the support is due to come from European Union members with the IMF also contributing funds with members looking to offer protection to any countries that face financing difficulties.

The major central banks also reinstated the dollar swap lines to boost liquidity while the ECB will buy Euro-zone bonds, contrary to the comments made following last week’s ECB policy meeting. These measures pushed the Euro sharply higher with a high above 1.3000 on Monday as immediate fears surrounding the area eased.

There were still longer-term fears over the Euro-zone outlook, especially with fears that growth will remain generally depressed. With very subdued growth and the prospect of fiscal tightening, there will be expectations that the ECB will need to keep interest rates at very low levels over the next few months which will tend to sap Euro support. There were also fears that longer-term confidence in the ECB will weaken, especially in view of the controversial decision to buy bonds which drew some opposition from German Bundesbank members.

Defensive demand for the dollar also eased following the strong rally in stock markets, but there was still a further increase in Libor rates during the day which will maintain underlying doubts over inter-bank strains. From highs above 1.30, the Euro steadily lost ground and retreated to lows below 1.28 in US trading.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk appetite improved on Monday following the EU package and the announcement of swap lines while equity markets were also firmer. In this environment, yen demand weakened and the dollar pushed to the 92.80 area with the yen also weaker on the crosses as equity markets retreated.

The dollar was able to maintain a firmer tone against the yen in US trading with a move to just above 93.25. The Japanese currency was able to regain some ground against the Euro and the overall yen performance still suggested that there was underlying caution surrounding global markets and yen buying pressure could return.

Sterling

Talks between the UK political parties continued over the weekend, but no announcement of a coalition government deal was agreed with talks continuing during Monday. Wider international developments dominated initially and Sterling was able to push towards the 1.49 area as defensive dollar demand faded following the Euro support package. There was further buying support in European trading and the UK currency pushed to a high above the 1.50.

The Bank of England left interest rates unchanged at 0.50% following the latest MPC meeting. The amount of quantitative easing was also left on hold at GBP200bn while there was no statement from the bank. The minutes, which will be released in two-weeks time will be watched very closely to assess whether the bank is more concerned over inflation.

The central bank inflation report will also be watched very closely on Wednesday for further evidence of the bank’s economic assessment and the prospect for higher interest rates.

Late in European trading, Prime Minister Brown announced that he would resign and this increased speculation that there could be a labour-Liberal Democrat coalition deal. This tended to put downward pressure on Sterling, especially as there would be fears over an unstable administration which could undermine action on the budget deficit. Sterling dipped to a low towards 1.4850 against the dollar.

Swiss franc

The dollar weakened to a low around 1,0925 against the Swiss franc on Monday, but found support close to this level and strengthened steadily to a high above 1.11 in New York. The Euro consolidated around the 1.42 area against the Swiss currency.

The Euro-zone support deal may curb immediate franc demand to some extent, but underlying confidence surrounding the Euro-zone economy is likely to remain very fragile and there is unlikely to be sustained selling pressure on the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

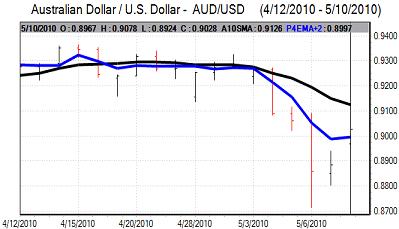

Australian dollar

There was an Australian dollar jump higher in early Asia on Monday as the Euro rallied strongly following global support measures. Risk appetite will also be firmer in the near term which will help underpin the Australian dollar, but there is still likely to be a general mood of caution which will curb buying support.

There was a peak near 0.9070 in Europe before a retreat to the 0.90 level as the US currency regained ground against European currencies.