The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!

Today’s Golden Sunrise

Friday, April 30, 2010

Hours of daily research consolidated for you

The market had a very positive day yesterday on a day when it could have gone the other direction. Good news on Greece, I guess.

The Greek Prime Minister is saying they need this to avoid catastrophe, the number is now up $159 billion over 3 years for 2.6% of the European Union GDP..which quick math means 6.6Trillion if the whole thing needs to be bailed…The Euro groups are going to meet this week-end to figure out the plan for the Greek parliament to approve next week.

The Greek shopkeepers are planning to close on the days when the unions take to the street with the Union Leader calling this an unwarranted, unjust attack.

So,, the firetruck arrives at your burning house and you stop the fire crews to make sure they don’t track mud into the house…

This is going to work out real well and is certainly something for markets to rally over.

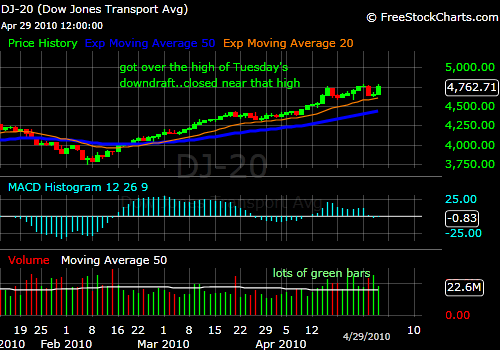

But rally they did…getting back almost all of the Tuesday’s decline.

The transports were really strong and over ½ this 15 member group up 2% on the day.

New highs were 510; new lows 17..51 medical companies and 49 real estate firms lead that parade. Retail which had 79 a couple of days ago had 18 yesterday. Seven miners among the group of new highs-I own 2 which is a good percentage.

I like the Stocks on the Move section which is short-hand for companies trading on higher than normal volume. This is designed to show you quickly what the big buyers, the institutions are doing. Broken down into NYSE and Nasdaq sections, it has stocks up and stocks down within it. Nerd-freak minutia guy that I am, I log this stuff. Yesterday, with pretty good breadth in the market, that was positive, the NYSE SOTMs had 30 stocks up and 16 down. This is the second day this month the up number has been bigger than the down. Read that sentence again. The Nasdaq on a day it was very positive had 16 up and 30 down. But it has had more ups than downs on 3 other occasions this month. The numbers for the first 4 months of this year are very similar. I will cough them up one of these days but all is not a bed of roses marketwide.

Things looking ok…Silver on a daily…

Gold: broke an important level..if it holds it, we got upside action.

Here’s a very interesting gold chart…this is a weekly…love to see a retest of the lower channel..the blue 50 period average has been a support level for quite a while now and the 20 providing help too.

GDP came in about as expected..gold up this morning

The mint sold 1,493,000 in 2009, second only to the 1.5mil in 1999 with the Y2K scare. Sales of the half ounce were 110,000, the quarter ounce was only 110,000 and the 1/10 ounce was 270,000.

When the government confiscated gold from US citizens in 1934, it allowed them to keep numismatic gold. If people begin buying all the denominations to form collections, the ½ and ¼ might have some real rarity upside, in addition, to price appreciation for gold. Something to think about.

The Buffalo, which we will cover in the future, had 200,000 sold.

Sales for 201o are sharply higher than 2009. One out of every 221 citizens bought a gold eagle last year if each buyer was limited to one. Point is, not many did…this seem smart to you?

JohnR

Goldensurveyor.com

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!