As an agricultural product whose production is concentrated in a few key regions, Coffee is a market that lends itself well to fundamental price projection. Like many of its agricultural cousins, the harvest cycles of the coffee trees themselves creates seasonal tendencies that can be studied and potentially exploited by astute investors.

In particular, option sellers have a particularly keen interest in “seasonals” as they are not bound by the limitations of the futures trader who a) requires perfect timing and b) has to be correct on outright price direction.

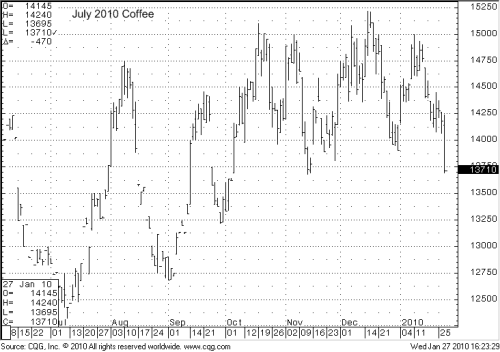

As coffee prices have just come off one year highs back in December, call sellers may be asking themselves if it is time to consider selling some inflated call premium. The answer, in our opinion, is Yes.

Coffee tends to establish seasonal highs in the December to January time period each year. While there is no guarantee that will be the case this year, the same fundamental factors that drive this tendency are in place to see it repeat.

Coffee is a market where nearly 50% of its production derives from two nations – Brazil and Vietnam. As the Vietnamese harvest begins in March and Brazilian harvest in May, the months immediately proceeding this time period will be the time of year where supplies are tightest. Prices tend to reflect this tightness. Yet, as harvest approaches, prices often tend to begin trekking lower in expectation of the influx of supply.

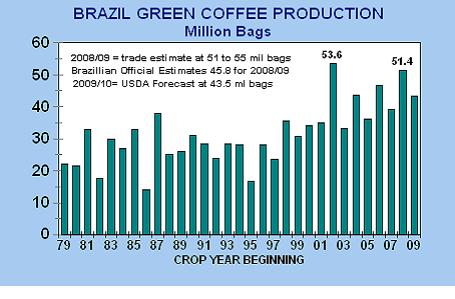

The outright production numbers can have a big effect on prices as well. Coffee prices were relatively firm in 2009 as a reduced Columbian crop (3rd largest global producer), put pressure on Brazil to make up the difference. Heavy rains during the critical Brazilian “flowering” season brought in additional fund interest. 2009 was also an “off” year in the Brazilian production cycle with Brazil producing near 44 million bags of Coffee according to the USDA.

Brazil’s coffee trees have an every other year “on/off” cycle as trees will “rest” in the years between big production numbers.

However, 2010 is expected to be an “on” year for Brazilian production. Counting coffee beans tends to produce different numbers depending on who is doing the count. The official CONAB estimate for the 2010/11 Brazilian crop is 44.03 million bags of coffee. However, CONAB represents the Brazilian government crop supply agency which is notorious for understating the size of the crop (Coffee is a key cash crop in Brazil and lower supply projections can often help support price). However, Conab estimates have historically been about 10-15% lower than the actual supply numbers. USDA numbers have tended to be more accurate.

With that in mind, this year’s actual Brazilian coffee harvest could be upwards of 50 million bags. Liberty Trading’s official estimate to Reuters earlier this month was 53 million bags – an all time record.

The USDA’s initial estimate for the 2010/11 Brazilian Coffee Crop is expected to be near a record. This chart will be updated upon it’s release.

Brazil played up the heavy rains during flowering season back in October. It was thought that heavy rains hindered the development new crop coffee. However, it has been my experience that too much rain is rarely bad for any crop over the long term. While excess moisture may have adversely affected 10% or so of Brazilian coffee beans, it was more than likely quite beneficial to the other 90%.

Look for the upcoming Vietnamese harvest and the market’s growing focus on the 2010 Brazilian crop as limiting factors to higher prices in the ICE Coffee contract.

While markets have experienced dollar related selling over the past week, the prospect of hefty incoming supply should put seasonal pressure on coffee prices. In the event of US dollar weakness, expect coffee to have muted upside potential as overhanging supplies should begin to discourage heavy fund long positions.

This market has the right fundamental set up for call sales. In addition, coffee has been a market that has historically offered healthy premiums on deep out of the money calls. As always, we favor selling the options at 50-100% out of the money. Those kinds of strikes are available here.

More conservative traders may want to wait for dollar or weather based rallies over the next 30-60 days as opportunities for positioning. However, we feel there will be plenty of opportunities for reaping premium in the coffee market as Q1 2010 progresses.

To learn more about selling options in the commodities markets, feel free to visit us on the web at www.OptionSellers.com. A complimentary option selling information pack is available for qualified investors.