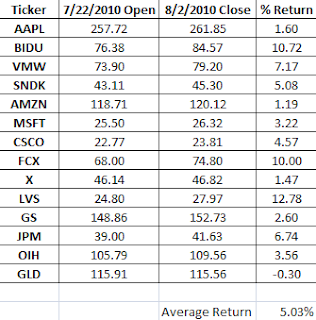

On July 22nd when the S+P broke its downtrend I wrote an article saying there was an opportunity to build a core portfolio of our go-to stocks. Now 11 days later, let’s take a look and see how the portfolio is performing. Below is the S+P chart where I noted the macro buy opportunity.

And here is a SPY daily chart from today

AAPL – Still holding in the macro range but has had a nice move higher since our first buy area. The next buy area will be when the stock gets above 264-265 on heavy volume.

BIDU – Made new highs and continues to be strong as the market pushes higher.

VMW – Has been a leader all year and continues to act very well. Look for it to

push through and make new highs in the coming weeks.

SNDK – Missed on earnings but held the 40 area and traded lower before sharply rebounding. It is now working its way through its macro base.

AMZN – Sold off heavily after missing earnings estimates but then pared back almost all of its losses the next day. If you looked into the reasons they missed the report did not seem so bad. The next actionable buy area is 119.50-120.50 which would resolve the downtrend to the upside.

MSFT – Slowly grinding higher and is holding strong above the 8 and 21 day EMA’s

CSCO – Made a higher low on the July 22nd buy day. Look for this stock to gain momentum if it can get through the 200-day MA at 24.25

FCX – Resting after a big move but could be poised to make a move to its 200-day MA around 76

X – Consolidated after a big move up but is ready to go again. We had an excellent trade in this stock over the past 2 days.

LVS – Trying to push through and make new highs today to build on the 10.89% return it has already given us in the past 11 days.

GS – Broke out of it’s wedge and gave us a good move a couple days. It was a great buy at 138.50 and more recently was a good buy at 149.50 on Thursday. The stock still has room to 158-160.

JPM – Very strong trading right at its 200-day MA after a good move up.

OIH – Excellent trade for us since 98 and today moved above 107 leaving an easy path to 112-114.

GLD – Good cash flow trade for us the past couple days.