By: Zev Spiro

The major market indices continue to trade in a volatile range. Below is a macro long idea for MicroStrategy Inc. (MSTR) and a short opportunity in RealPage, Inc. (RP).

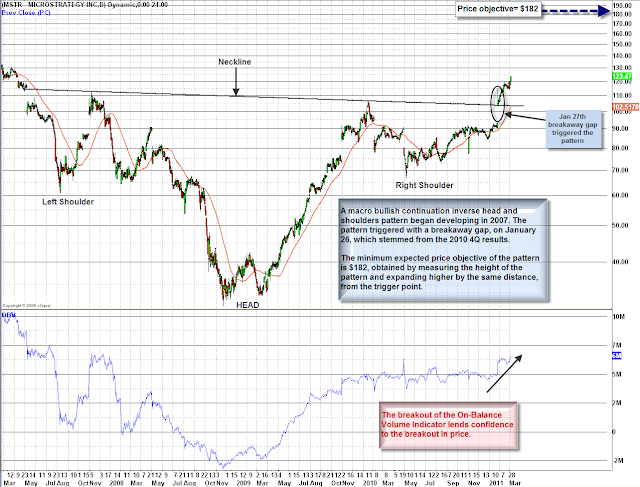

Chart 1: MSTR: A macro bullish continuation inverse head and shoulders pattern began developing in 2007. The pattern triggered with a breakaway gap, on January 26, which stemmed from the 2010 4Q results. The minimum expected price objective of the pattern is $182, obtained by measuring the height of the pattern and expanding higher by the same distance, from the trigger point.

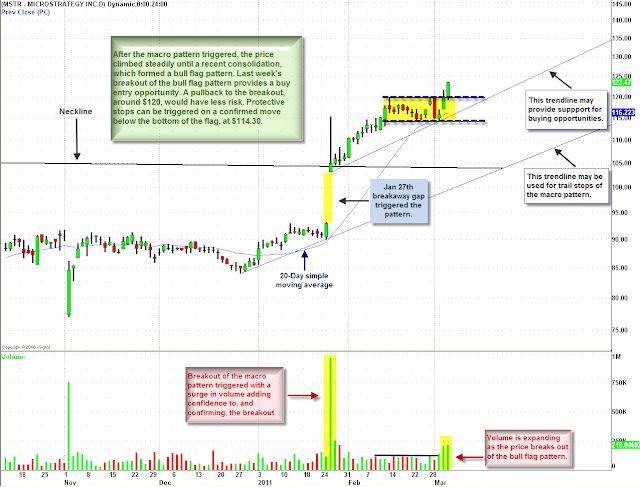

Chart 2: MSTR: After the macro pattern triggered, the price climbed steadily until a recent consolidation, which formed a bull flag pattern. Last week’s breakout of the bull flag pattern provides a current buy-entry opportunity. Waiting for a pullback to the breakout, around $120, would have less risk, although, it may not pull back to that level. Target: $182, is the minimum expected macro objective. Protective stop: confirmed move below the bottom of the flag, which is at $114.30.

Chart 3: RP: A complex bearish head and shoulders pattern triggered on February 25th. Currently, a low-risk opportunity presents itself by shorting a bounce versus the neckline, which is resistance of the pattern. The neckline is currently around the $26 level. Target: Minimum expected price objective is 18 dollars, Protective stops: may be activated on a confirmed move above both, the neckline and the 50-day Simple Moving Average (SMA).

Updates:

1) STRI: Market Letter 2/24/11: approaching the short term target of $15. Conservative stops may now be trailed down to a confirmed move above $18.

2) PCX, ANR, AOS, MON, MAN: Market Letter 3/2/11: None of these setups have triggered yet but all are still valid.

If you are interested in receiving Zev Spiro’s market letter, please email zevspiro@oripsllc.com subject “T3”

*DISCLOSURE: Long MSTR; Short STRI, PCX, ANR, MON.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.