By: Zev Spiro

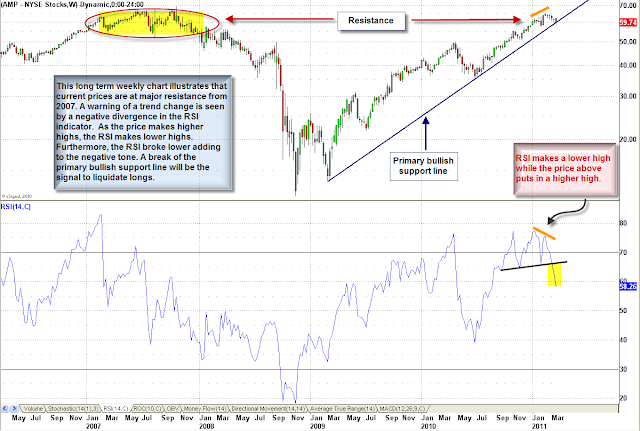

A macro bullish trend has been in place for Ameriprise Financial Inc. (AMP) since early 2009. Currently prices are at major resistance from 2007 and may be close to a trend change. There is a negative divergence seen in the RSI indicator on the long-term weekly chart. As the price makes higher highs, the RSI puts in lower highs. A confirmed break below the primary bullish support line will be the signal to liquidate longs. In addition, a potential bearish head and shoulders pattern may be forming on the daily chart that will trigger with a confirmed move below the neckline, at 58 dollars.

Chart 1: Long-term weekly chart illustrating the macro trend, 2007 resistance and a negative divergence from the RSI.

Chart 2: Outlines a potential bearish head and shoulders pattern, which if triggered, will probably coincide with a confirmed break of the primary bullish support line on the weekly chart. Trigger: confirmed break of the neckline, at $58 Target: Minimum expected price objective is $51, Protective Stops: confirmed move back above the neckline.

UPDATES:

CREE INC. (CREE): Market Letter 3/15/11 – There was a significant gap-down with a surge in volume on bad news yesterday. Resistance should now be provided by the lower end of the gap, at $46.36. Protective stops may be trailed down to trigger on a daily close above $49.

HAVE A GREAT WEEKEND!

If you are interested in receiving Zev Spiro’s market letter, please email zevspiro@oripsllc.com subject “T3”

*DISCLOSURE: Short CREE, AMP

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.