EUR/USD

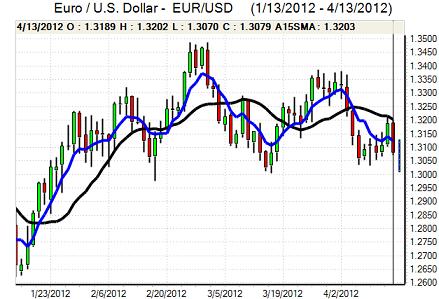

The Euro initially found support in the 1.3150 region against the dollar on Friday, but rallies encountered tough resistance and it weakened sharply during the New York session.

There were further major concerns surrounding the Spanish outlook as benchmark bond yields rose back to near the 6.0% level. There was also an increase in credit default swaps to a record high just below the 500 basis point level. In particular, markets were uneasy following data which showed that Spanish bank borrowings from the ECB rose very sharply during March which suggested that Spain would have increasing difficulties in securing credit-market access which further undermined sentiment.

There was further uncertainty surrounding ECB policies with council members denying suggestions that there could be a resumption of the bond-buying programme to support Spain. ECB comments will be watched very closely over the following week.

US consumer prices rose 0.3% for March with a core increase of 0.2%. At this stage, markets are likely to look more at demand-side indicators to asses economic policy rather than inflation, especially with persistent speculation that the Federal Reserve could relax monetary policy again through additional quantitative easing.

The University of Michigan consumer confidence index dipped slightly to 75.7 for April from 76.2 previously. Fed Chairman Bernanke did not make any substantive comments on monetary policy in a speech on Friday. The Euro lost support in the 1.31 area against the dollar and dipped to lows below 1.3075. Despite a brief advance in early Asia, the Euro was subjected to fresh selling pressure with one-month lows just above the 1.30 level.

The latest IMM positioning data recorded a renewed increase in short Euro positions which may make it difficult for markets to push the currency substantially lower.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was trapped in narrow ranges against the yen during Friday with support on dips towards 80.80 and resistance above 81.10 as both currencies tended to move in tandem. The dollar was curbed by a lack of additional yield support following uninspiring economic data.

The yen continued to gain some net support from a lack of enthusiasm for major alternatives, especially with fresh fears surrounding the Euro-zone outlook. With the National Bank blocking Swiss franc gains, there is the potential for additional yen buying. This will, however, also fuel expectations of additional Bank of Japan action to weaken the yen.

Regional equity markets were generally weak during Monday which provided further defensive support for the yen with China’s move to widen the yuan trading band raising concerns that volatility could increase. The dollar was still able to find support in the 80.70 area.

Sterling

Sterling initially found support near 1.59 against the dollar and rallied to a peak above 1.5950 before selling pressure intensified. There was position adjustment following the failure to break above the 1.60 level and wider global currency trends intensified the move.

Producer price input costs rose a higher than expected 1.9% for March which may have some slight impact on Bank of England inflation expectations, although the principal effect is liable to be on corporate profit margins rather than monetary policy. Similarly, the latest consumer inflation data may have only limited policy implications at this time. As the US currency strengthened, Sterling dipped sharply to lows below 1.5850 against the US currency.

There were still expectations of defensive Sterling from Euro-zone fears, especially with Spanish fears intensifying. In this context, there was some speculation that the Bank of England would voice concerns over a firmer Sterling trend. Sterling dipped lower again in Asia on Monday in line with a weaker Euro as the Rightmove organisation confirmed a 2.9% price increase for March.

Swiss franc

The dollar was able to resist a further test of support in the 0.91 region against the franc on Friday and advanced to highs close to 0.92 later in the US session.

The Euro was able to avoid a further test of support close to 1.20, although gains remained very limited as Euro-zone fears continued to intensify. There were persistent fears that Euro-zone stresses would divert funds into the Swiss currency which could force the National Bank into even more aggressive action to prevent fresh Euro losses. The latest producer prices data will be watched closely on Monday to assess the underlying deflation risks.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar hit resistance close to 1.0420 against the US currency on Friday and retreated back to the 1.0370 area, although the currency was able to trade with a slightly more positive outlook on the crosses.

The Australian currency was unable to regain the 1.04 level in Asia on Monday and weakened to lows near 1.03 as risk appetite was generally fragile with unease over the threat of a slowdown in Australian exports and expectations that the Reserve Bank would sanction a further cut in interest rates.