EUR/USD

The Euro found support close to 1.3120 against the dollar on Friday and had a slightly firmer net tone, but it was unable to break above the 1.32 level. The Greek situation inevitably remained an important focus during the day as negotiations continued ahead of Monday’s Eurogroup meeting. Greek officials attempted to take an optimistic tone during the day and there were reports that deal could be secured on Monday. The government also announced over the weekend that additional savings worth EUR325mn had been agreed which will help appease fears.

There was, however, still a high degree of scepticism surrounding the situation. There were major doubts surrounding the sustainability of the Greek deal with particular concerns surrounding the German Finance Ministry with speculation that they were pushing for Greece to be allowed to default. The Dutch Finance Minister also stated that he would have voted against the Greece loan deal earlier in the week had the planned meeting taken place.

During the New York session, there was a report that the IMF was cutting back its commitment to Greece which undermined confidence again while it was also reported that the Bundesbank’s Weidmann had voted against the ECB Greek bond swap as uncertainty remained very high.

The headline US consumer prices report was slightly lower than expected at 0.2% while the core rate was in line with expectations, also at 0.2%. The data will maintain speculation that favourable inflation trends could lead to further quantitative easing if there was fresh deterioration in the economy.

The latest speculative positioning data recorded a renewed increase in Euro shorts and a sharp increase in long dollar positions. There was greater optimism that a Greek deal would finally be secured and, with risk appetite also firmer, the Euro pushed above the 1.32 level in Asia on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to the 79 area against the yen on Friday and continued to advance during the day with a fresh 16-week high above 79.50 as the yen was also vulnerable on the crosses.

The US currency failed to gain much additional yield support, but the yen was subjected to further selling pressure as global risk appetite improved. The Chinese central bank decision to cut reserve ratio requirements should also be important in undermining any defensive yen support.

The latest Japanese trade data recorded a record monthly deficit of JPY1.5trn for January and fears over the longer-term outlook increased even though January is traditionally a weak month for the trade account. The dollar pushed to 6-month highs near the 80 level before falling back as resistance remained tough to break.

Sterling

Sterling found support close to 1.58 against the dollar on Friday and pushed higher following the latest UK economic data.

The retail sales report was much stronger than expected with a 0.9% increase in volumes for January compared with expectations of a monthly decline and following a 0.6% increase the previous month. It is possible that the data was distorted by price discounting and seasonal trends, but there was still a further easing of concerns surrounding recession which helped underpin Sterling confidence as a whole. The UK currency was also boosted by a record increase in the Rightmove house-price index of 4.1% for February although the index records asking prices and values actually received may be significantly lower.

Euro-zone developments will be watched very closely and there will be potential safe-haven support if confidence in the Euro area deteriorates again. The impact will, however, be mixed as the UK currency will be more vulnerable in the event of a wider downturn in risk appetite. Sterling pushed to a high near 1.5880 on Monday reflecting a wider US dollar retreat.

Swiss franc

The dollar was confined to narrower ranges against the franc on Friday as it was unable to move above the 0.9220 area while there was support on dips towards 0.9150 with this area tested again in Asia on Monday. The Euro resisted further selling pressure and pushed back to the 1.2090 area.

There were reports that interim National Bank Chairman Jordan was under investigation following the resignation of Hildebrand and, although such investigations may be a routine matter, there were doubts surrounding his appointment potential as permanent head which may also trigger some fresh uncertainty over the Euro minimum level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

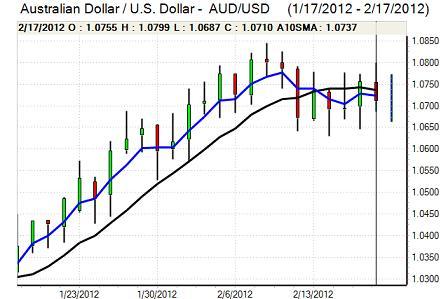

Australian dollar

The Australian dollar hit resistance close to 1.08 against the US currency on Friday and dipped to test lows below 1.07 late in the US session as there was wider support for the US currency. The ebbs and flows surrounding Greece’s loan package continued to dominate for much of the time and the currency rallied again early in the Asian session on Monday as there was greater optimism.

The 0.5% cut in China’s Reserve Ration Requirements also helped bolster risk appetite which underpinned demand for the Australian currency, although there was further selling pressure above the 1.08 level.