EUR/USD

The Euro found support in the 1.2720 region against the US dollar on Tuesday and pushed higher during the European session as short-term sentiment improved to some extent.

The German ZEW data was significantly stronger than expected with the headline business confidence index advancing to a six-month high of -21.6 from -53.8 previously and this was the strongest ever recorded one-month advance. There was also a decline in Spanish yields in the latest bond auction which helped underpin sentiment to some extent. There were still major fears surrounding divergence within the Euro-zone area with German economic gains not matched elsewhere and there were also concerns surrounding political divergence following the French AAA credit-rating downgrade which will tend to put additional medium-term strains on the Euro.

There were further talks between the Greek government and major bond holders as they battled to secure a debt-restructuring deal. Even if a deal can be put together, there will be fears that it will be deemed as a default by the major credit-rating agencies. Fitch warned in blunt language that Greece was insolvent and would default soon which had some impact in curbing Euro demand after it reached the 1.28 area.

The New York manufacturing PMI index was stronger than expected with an increase to 13.5 for January from 8.2 previously, maintaining the generally robust tone of recent economic releases. The data had some impact in underpinning risk appetite and this also tended to dampen defensive US demand to some extent with markets also on alert for comments from Fed officials ahead of next week’s FOMC meeting.

After retreating back to the 1.2710 area, the Euro recovered back to the 1.2780 area in Asia on Wednesday as there was further evidence of short covering following the increase in short positions to fresh record highs.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to the 76.50 area against the yen during Tuesday, but the underlying performance remained unconvincing at best as it was unable to strengthen through the 77 area. Movements on the yen crosses continued to have an important impact as the Euro attempted to recover from 11-year lows while Sterling also attempted to hold above long-term technical support levels.

The Japanese currency again proved broadly resilient when there was an improvement in risk appetite which continues to suggest solid underlying demand for the Japanese currency. Intervention will again be an important focus if there is any strengthening through the 76.50 area and there will be nervousness over the possibility of Bank of Japan action.

Sterling

Sterling was unable to make strong headway during Tuesday and there was tough resistance on approaches to the 1.54 area which helped trigger a re-test of support near 1.53 during the US session.

Headline consumer inflation fell to 4.2% in December from 4.8% previously and there was a smaller decline in the core rate to 3.0% from 3.2%. The headline rate will continue to fall sharply in the short term as 2011 tax increases come out of the calculation and retail discounting will also have an important impact.

In testimony to the UK Treasury Committee, Bank of England Governor King generally concentrated on technical issues surrounding the banking sector. There was further speculation that additional quantitative easing would be sanctioned within the next two months as the bank remained extremely uneasy over the Euro-zone impact. Positive comments from ratings agencies should lessen the risk of aggressive Sterling selling.

Swiss franc

The dollar found support on dips to the 0.9450 area against the franc and briefly pushed back above the 0.95 level before reversing course again as it was generally unable to sustain momentum with tough underlying resistance above 0.9550. The Euro also had difficulties in holding above the 1.21 level.

The Swiss Finance Ministry continued to insist that a fair range for the franc against the Euro was 1.35-1.40 and the government will continue to promote a weaker currency. Markets remain sceptical whether the National Bank will be willing to adjust policies at this stage, but there will inevitably be caution over buying the Swiss currency aggressively.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

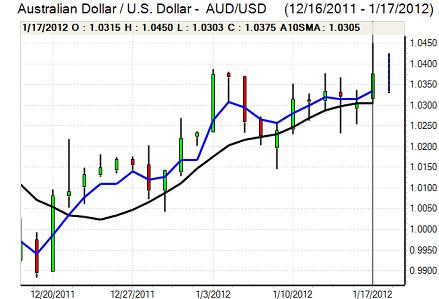

Australian dollar

The Australian dollar maintained a solid tone during the past 24 hours and pushed to highs around 1.0430 against the US currency before edging lower. Risk conditions remained important with the currency continuing to gain underlying support from an improvement in confidence following the Chinese GDP data.

There was a recovery in domestic consumer confidence according to the latest Westpac survey data and there were expectations of a rebound in employment in the releases due on Thursday which also had a positive impact on the currency, although the impact was offset to some extent by a decline in car sales.