By: Scott Redler

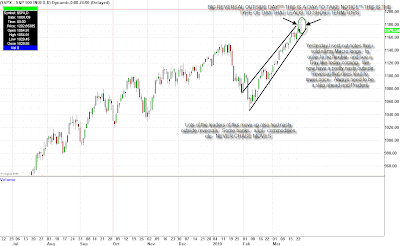

Yesterday I sent out a note across the T3Live community stating that I am sellnig my macro longs. This rally has met my targets and it’s now time to get flexible. 1,110-1,170 was the “meat of the move.” I did not see a topping-type pattern yesterday, but was just cleaning up my risk. TODAY we had a major topping tail–an outside day, RedDog Reversal, etc.–in all the indices. Many key stocks had nasty reversals: AAPL, the banks, commodities, etc.

This is why you don’t chase moves. You can always leave a little on the table in order to be flexible and see a day like today coming.

This is a day to take notice. A day to pare down positions and really be flexible. I know it’s a taboo, but maybe even “short the market” if you’re quick and experienced. Now it’s time to see if this rising channel that has been intact since February 5th gets violated.