(QQQ)(SPY)(WMT)(AAPL)(GRPN)

by DeWayne Reeves

S&P500 Emini Futures Close Week At Highest Weekly Trading Zone

The S&P Futures finished the week at 1404.75. High of the week was 1407.50. Our highest Weekly Trading Zone was 1406/1407. Weekly Zones are emailed to CFRN Partners prior to the market opening on Monday and also provided to those taking our Free Trial in the Live trading Room.

(ES) Weekly Close S&P 500 Emini Futures

Earlier in the week on Tuesday we saw a “Touch and Go Landing” at the 1374/1375 Weekly Zone. This is significant in that we touched this Zone twice and saw no real consolidation. The market reached down from 1385 to touch the Zone almost in a compulsive type move, as though it had no other choice. You know, like the last rattle of the front door nob before retiring?

(ES) S&P500 “Touch And Go” Test

(ES) S&P500 “Touch And Go” Test

When we see this, we make a little note in our trading journal. Chances are, price will be back to visit in the near future to spend some time and expend some energy in and around this 1 point range. Even though 1374/1375 may not be a Weekly Trading Zone next week, Zones often have what we call a carryover effect. Make a note to watch it for yourself and we’ll see what unfolds.

Be sure to watch the Globex open with us Sunday night as we may see some very interesting and potentially profitable opportunities. Trade with us via Twitter – @CFRN .

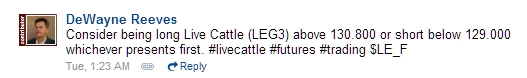

We Took A Stab At Live Cattle Last Week

One thing that makes the CFRN Indicator Set and Methodology so unique, is that it works well across multiple markets and multiple time frames. We are able to do this because we have identified an underlying rhythm that is present in all auction style markets. If there’s a bid and an ask, if it can be charted, if there is participation, we can teach you how to trade it using our tools and our methodology.

This sounds like a tall claim doesn’t it? Last week, just to point out the enormous possibilities available to CFRN Partners, I decided to wander as far away from the Indices as I possibly could. Anyone who follows us has seen our work in the S&P, Dow, Russell, Nasdaq, Euro, Soybeans, and Gold just to name a few. I really wanted a challenge. I went looking for the Pork Belly symbol and couldn’t find it. Turns out the politically correct terminology is now Lean Hogs. I did not know that.

Unable to locate a decent Pork Belly I stumbled across Live Cattle. I said “Aha!”. (I really did) Having no experience in this “field of work”, no knowledge of any fundamentals, my goal was simply to apply the CFRN Indicator Set and Methodology to see what would happen. Once my chart was set up the trade literally leapt off the page at me. Could it really be that simple?

Out on the limb where I spend a lot of time and keep a little cook stove and some blankets, I issued this Trade Idea initially to our followers on Seeking Alpha –

If you don’t follow us there, here’s a really good reason why you should…

(LEG) Live Cattle Trade Setup

(LEG) Live Cattle Trade Setup

The end result was a 212 point rally once we were triggered in. Based on the Bullish Close, there might be more in store. If you are still long, be sure to lock in some or all of your profits. Each point pays $40 and there are 4 ticks in a point. The maximum profit potential in this trade was $8,480 per contract traded.

Past performance is no guarantee of future results.

British Pound (6B)

Last week’s TWEET on the Pound looked like this –

Consider being long the British Pound (6BZ2) above 1.5945. #britishpound #6bz2 #currencyfutures $6B_F

— DeWayne Reeves (@CFRN) November 20, 2012

Here’s how it turned out –

(6B) British Pound Tweet

(6B) British Pound Tweet

The Pound pays $6.25 per Pip which means a maximum potential so far of $662.50 per contract traded. Our highest Weekly Trading Zone for the Pound was 160.10/160.15 and was exceeded on bullish momentum. If you are still long this trade be sure to lock in some or all profits.

Nasdaq (NQ)

Here’s the TWEET –

Consider being long the Nasdaq #NQZ2 above 2605 or short below 2550 whichever presents first. #emini #trading #Nasdaq $NQ_F

— DeWayne Reeves (@CFRN) November 21, 2012

Here’s the results so far…

(NQ) Nasdaq Emini Futres

(NQ) Nasdaq Emini Futres

The Nasdaq futures pay $5 per tick, or $20 per point. The profit potential in this trade so far, $660 per contract traded. Many CFRN Partners are quite fond of the Nasdaq and daytrading margins with our preferred broker, Daniels Trading, is only $500 per contract. If you have questions regarding margins, funding requirements, etc… call Burt or Leslie @ 866-928-3310 for a one on one consultation. Be sure to let them know you are a Partner, on a Free Trial, or a member of the CFRN Family at large.

Soybeans Deliver The Rare 4th Bite

(ZS) Soybean Tweet

(ZS) Soybean Tweet

As opportunities unfold we will keep you posted.