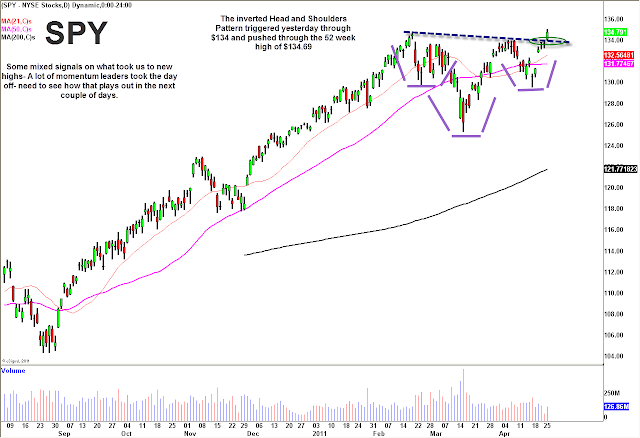

US stock futures point slightly higher once again Wednesday morning after making new multi-year highs yesterday. The jump in the S&P yesterday triggered the inverted head and shoulder pattern we have been highlighting, which would take the index to a measured move of 1410-1440. When approaching important news like a Fed rate decision (which is coming today at 12:30ET), markets often rest and make their move after, but this time around traders were too giddy to wait. Today’s Fed Day is unique because for the first time chairman Ben Bernanke will be holding a press conference, while not many know what to expect from this unprecedented step.

DJIA INDEX 12,549.00 +31.00

S&P 500 1,345.10 +4.20

NASDAQ 100 2,398.75 +14.00

Despite a wave of very negative headlines, the bull market remains alive and well. Yesterday’s move showed tremendous breadth and momentum stocks did not really lead the charge.The fuel for this precipitous week-long bounce has been another impressive earnings season. Tech sector earnings have been especially impressive, with Apple Inc. (AAPL) among the giants reporting stellar quarters. Amazon.com, Inc. (AMZN) was the latest tech giant to report after the close yesterday.

The e-commerce website missed significantly on its EPS number, but that miss was due to special spending to enter the cloud computing game, which holds major promise for the company. The rest of the report was strong, and investors, after initially selling AMZN stock off sharply, brought it all the way back. AMZN is basically flat this morning.

Watch the T3Live.com Morning Call with Scott Redler and Alix Steel (below).

As I alluded to, momentum stocks took a little bit of a break and it was hard to fathom, at first glance, how the market was so strong yesterday. Chinese Internet stocks, which had been the darling of the part for the past few weeks, sold off hard as investors moved into safer, more value and dividend oriented investments. Both Sohu.com, Inc. (SOHU) and SINA Corporation (SINA) were down around 3% yesterday, and it will be important to see how they respond today. Even a market leader like Apple Inc. (AAPL) was weak yesterday, and Apple strength is usually key to the market making new highs.

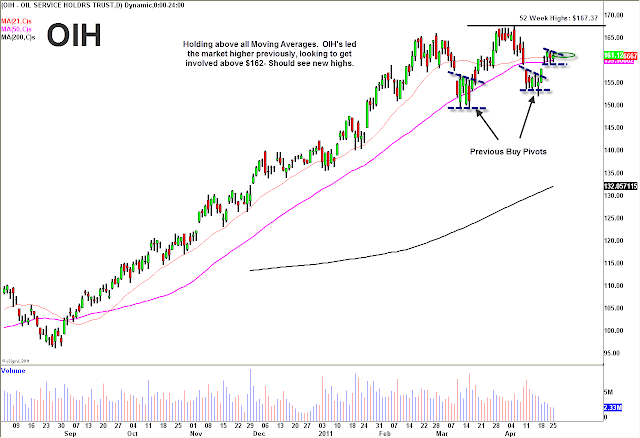

Perhaps the outperformance of mega-cap growth stocks this year is simply part of the sector rotation cycle, but it could be time to look for some of the less extended stocks and ETFs that could play catch up at this stage of the rally. One of those sectors is the oil servicers, which is represented by the Oil Service HOLDRs ETF (OIH). OIH has reclaimed its moving averages, and has been basing nicely above them for several days. Look for OIH to bounce off these levels. The most attractive stock chart in this sector is Halliburton Company (HAL), which poked its head to new highs yesterday. The largest component of OIH, Schlumberger Limited (SLB), has been relatively weak and just starting to retake its moving averages.

A sector that has been even weaker this year has been the optical networking stocks, which were sent tumbling last quarter by an extremely weak earnings report that presented a weak outlook from Finisar Corporation (FNSR). Two others in the sector, JDS Uniphase Corporation (JDSU) and Ciena Corporation (CIEN), we feel were perhaps unfairly punished and traders have been looking for a bounce. CIEN has a better looking chart than JDSU, as it has just broken out of a long-term wedge pattern.

The casinos group as a whole has not been relatively weak (Wynn Resorts, Limited (WYNN) has continued to make new highs after a blockbuster earnings report), but the sector is a story of haves and have nots. While WYNN has been strong, Las Vegas Sands Corp. (LVS) has been unable to really pop following a weak earnings report last quarter. Right now, though, LVS looks good, having put in a multi-day consolidation after breaking above a long-term downtrend. Look to buy LVS on a break above that consolidation.

The fertilizers looked promising early yesterday, with leader PotashCorp./Saskatchewan (POT) bouncing off its moving averages, but it tailed all the way back down to its opening price. Although the action yesterday was bearish, as long as POT holds its moving averages we believe it should at least get back through pivot highs above $61.50.

*DISCLOSURE: Scott Redler is long SPY, GIGM, OIH, WFC, AAPL, POT, CIEN, JDSU, F, GLD, MGM, JPM, CRM, LVS, CSCO. Short SLV.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.