|

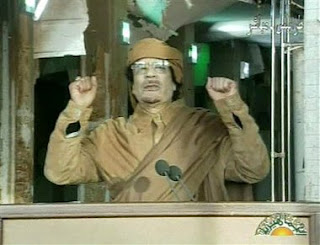

| Libyan leader Moammar Gadhafi gave a peculiar, disturbing speech yesterday encouraging his supporters to crack down on dissidents. |

US stock futures appear set to open higher Wednesday after yesterday’s steep decline. The futures dropped precipitously over the weekend as clashes in Libya grew more hostile and violent. Weakness started creeping into the market Friday even though the indices made new highs. Another side effect of the secular violence has been skyrocketing oil prices, which jumped almost 10% yesterday. With unrest and protests spreading throughout the Arab world, that trend shows no signs of abating.

Over the last few weeks the indices had accelerated out of their uptrends from early Fall, giving them an extremely overbought reading and making a correction likely. The market opened lower yesterday out of that sort of ascending wedge pattern and then fell off the cliff. The action felt noticeably heavy and could definitely lead to some more downside action.

While this morning we are getting a nice little premarket bounce, we are not yet at an area where active traders should be looking to aggressively buy, says Scott Redler of T3Live.com. The short term bottom COULD be in, but this area doesn’t provide the calculated risk reward Redler likes. That area would the 50-day moving average, which currently stands at around 1286 on the S&P. Corrective action is healthy for the markets.

Apple Inc. (AAPL) got hit hard yesterday as investors continue to be cautious due to Steve Jobs’s tenuous health. The stock closed the session right at big support at the lower trendline of the uptrend since late September, which also coincides with its 50-day moving average. Last night AAPL drifted below that level, but this morning has recovered those losses and more, set to open four points higher. The company will also be in focus Wednesday as it has its annual shareholders meeting.

As for the rest of the tech sector, which has been relatively weak during this correction, watch the moving averages. Many of the leading tech stocks that had extended higher tested their 21-day moving averages yesterday, closing at or near them. Two to watch closely are Baidu.com, Inc. (BIDU) and Netflix, Inc. (NFLX). If they can hold those moving averages this morning, NFLX and BIDU should get a bounce of some kind, but don’t be over-aggressive with them.

The agricultural stocks have been one of the hardest hit over the past week, and many accelerated to the downside yesterday. PotashCorp./Saskatchewan (POT) has been our favorite in the group over the last few months, but has been the weakest of the crop during this pull-back. The stock lost 5.5% yesterday and looks really damaged at this point. But we have a long-term bullish thesis on POT, so where is the area to look to buy this dip?

POT is already through its 21-day moving average, and the next area we will be looking at is the 50day moving average. That area is just below $165 right now, which coincides with a resistance area from the last big pullback in the ags that coincided with Cargill’s decision to offload its 64% stake in The Mosaic Company (MOS).

*DISCLOSURE: Marc Sperling is long POT, NFLX; Short XOM. Scott Redler is long GLD: Short SPY.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.