To find the hidden treasure, you need a map; you can’t just search aimlessly and hope to stumble upon it. In trading, the same concept applies. A lot of traders simply come in to work on a day to day basis and hope to stumble upon a good trade, without having a map to show them where the real money is. While it is important to have a basket of stocks you are familiar with, it is more valuable for momentum traders to have the wherewithal and resources to identify the hot stocks and hot sectors.

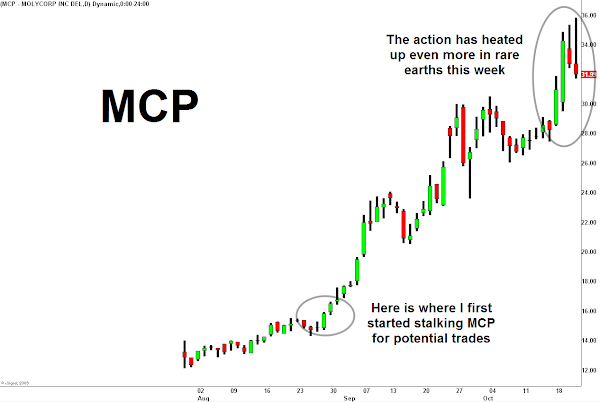

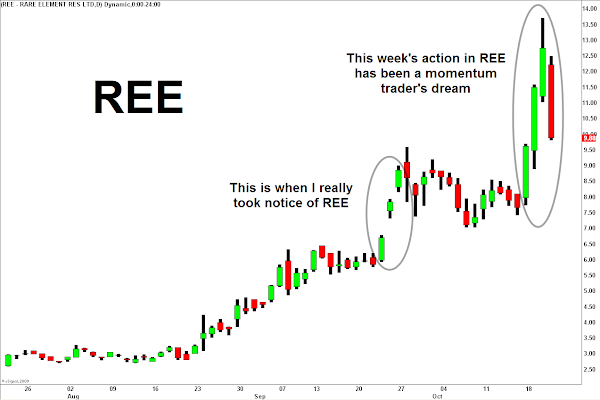

Over the last month or so, I have been trading the Rare Earth stocks heavily, namely Rare Earth Resources Ltd (REE) and Molycorp, Inc. (MCP). I got thinking about this topic as I looked at those around me twist and turn in the wind over the past few days, as correlation (and rhyme or reason) has been sucked out of this market. Many intraday traders come in every day and trade only the Apples (AAPL), Goldman Sachs’ (GS) and Amazons (AMZN) of the world, oblivious to the fact there are better vehicles for making money for a momentum trader. They get frustrated when they can’t make money, and I can’t help to think to myself, “they only have themselves to blame”. For an investor, it pays to research fundamentals about a company and to buy the biggest brands and such. But for a momentum trader like me it is all about finding the fast movers. The market in my eyes is nothing more than symbols and numbers, and I only really know what companies do so that I can tell other people what I am looking at.

We momentum traders look to indentify catalysts that will put a stock or a sector in play, as Steve has alluded to in previous Market Memoirs, whether it be news, IPO, etc. There are two steps to making money in hot stocks: 1) Knowing how to get there early and 2) Knowing when to walk away. The idea is to be first on the scene of these moves, and you do that by keeping your ears to the ground. The two main ways we find these hot stocks are by using filters and being active members of the T3Live community. We use news and momentum filters to identify momentum and stocks at key levels, but one person can’t catch everything, and that is where being part of a good community of traders pays off. My trading has continued to get better because of the quality we have in the T3Live chat room. Don’t lose money in whippy stocks that are highly computerized with black boxes programmed to take advantage of momentum traders; that is lazy. Pick the low hanging fruit by finding the stocks that are subjected to the irrational emotions of human traders. Use the tools around you to be in the right stocks at the right time, and that includes getting some help from a team.

The second step is knowing when to walk away (and often when NOT to walk away). When you find something that is working for you, ride that horse until it dies. Until the well runs dry, keep filling up your bucket. The latest example of this is the Rare Earth stocks REE and MCP. These rare earth stocks came on our radar as far back as early September, just more than a month after MCP had its IPO and broke through $15 with momentum. I kept them in my back pocket as they continued to climb, and then after REE broke out, then gapped up and ran 50% higher over three days on September 23, 24, 27, I began to focus even more closely eye on these stocks. Since that point, the ranges in REE and MCP have been huge, and have provided a great platform for a momentum trader to set up shop and go to work. In these situations, it doesn’t take rocket science to make money on momentum moves; I simply look for bull and bear flags on a 5-minute chart where I can quantify my risk while potentially getting in on a monster trade. As more eyes have come to the rare earth sector, the action has gotten even juicier this week. Monday, REE rocketed up almost 25%, and it has been more of the same from then on. Volatility has continued to ramp up, and I have shifted my focus almost completely over to the rare earth stocks. I am not married to the trade in either direction; that is the beauty of being a momentum trader. I am in and out, taking advantage of the irrational and exuberant nature of the herd as they come late to the party.

This past weekend I was up in Amish country in Lancaster, PA and learned a valuable lesson that is analogous to this topic. You milk the cow for all its worth until the milk runs dry. When the milk runs out you simply slaughter the cow and walk away. I am going to keep milking this cow until the last drop is squeezed out. Then I will move on to the next hot sector. The Amish would tell you only a fool gets married to a cow, and I would tell you that only a fool gets married to a trade. I will make my month trading these rare earth stocks, and when the time comes to move on, I will happily do so.