|

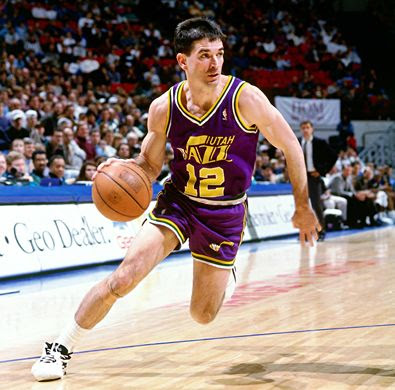

| While not the tallest, fastest or strongest, John Stockton knew how to execute |

In my 10+ years of experience in trading, I have seen a lot of smart people come in and out of the door. It goes the same way almost every time. He or she has great callouts and trade ideas. He or she is usually ‘smarter’ than me. He or she understands technical analysis, but doesn’t know how to execute. Next thing I know, this trader (who I thought was successful based on their ideas) is fired because they aren’t making money.

When it comes to trading, there are two main processes that allow you to make money: developing trade ideas and executing trades. Quality of execution is the difference between consistently winning or ultimately failing. It is the same way in sports (and in many other walks of life). The basketball player with the most potential doesn’t always go on to the greatest career because he can’t cut the mustard when the bright lights shine. On the contrary, there are the John Stocktons of the world, guys who have few in the way of physical gifts but work to develop a sense of uncanny feel for their craft.

For my short term momentum style of trading, execution is paramount. Before you execute a trade you have to identify an idea. You must understand it fully and create a gameplan for the trade. Very simply, I look for “in-play” stocks that have good patterns. What is a good pattern? A good pattern is a set-up that allows me to define my risk exactly. Tight bull and bear flags accomplish this well, for example, because my out is always on the other end of the range. Also, what does it mean for a stock to be in play? I look for several things, all relating to above average volume: earnings, recent IPO, news or any other reason.

To conceptualize it better, you have to realize that technical analysis is largely a self-fulfilling prophecy. A stock moves in a certain way often simply because everyone is looking for it to do the same thing. When a lot of eyeballs (or algorithms) are watching a stock and the volume increases, so does the amount of opportunity to make money. Volume is the footprint of money, and noting volume spikes intraday (or on daily charts for stocks capitulating to the upside or downside) allows you to find the stocks you should be trading. Understand what you are looking for in the trade, and don’t deviate from your plan. This applies on all time frames.

The next step is actually executing the trade. Traders fail in their execution in three different ways: too aggressive, too timid or wrong size. When traders are too aggressive, they try to attack the trade instead of letting it come to them. Patterns have exact trigger prices for a reason, and you should not load into a trade until that price level is breached. If you try to be early to a trade to get better prices, you will grow frustrated when it quickly reverses in your face. When the trade finally does happen you will be either stopped out for the day or watching another stock. This is the most common problem for me. When traders are too timid, they simply don’t have the confidence to take the trade when it happens. There are some people who are so concerned about being wrong and waiting the perfect moment, that a good moment passes them by. In terms of size, you have to be consistent with your trades. If you make 10 winning trades in small size, and then try to get big on the 11th one and lose, you can find yourself flat or negative. Be consistent with your size, and don’t get in too much size anticipating a move. Get only in a smaller feeler tier first, and add as the trade triggers through a defined level.

Enough talking about theory; I am going to give you a real life example from yesterday of where I made the mistake of being too aggressive. Virnetx (VHC) had been on a ridiculous run from $6 to $18, more than tripling in about a month and a half. The two extension bars, and high volume, on Monday and Tuesday told me that the bandwagon was getting crowded and it was time to put on my contrarian hat. When ‘bubbles’ burst, the outcome is usually a monster trade. One of my favorite strategies is to look for reversal trades where a parabolic stock trades higher in the morning and then back down through the previous day’s highs on huge volume. Virnetx (VHC) looked like the perfect candidate for a reversal. Yesterday in the morning the stock ripped to $20 early, and then began to head back down towards the previous day’s highs. I was chomping at the bit to take this trade. I fell in love with my idea and let it cloud the way I executed the trade. I got overaggressive.

If you look on the charta above (5-minute and daily), I circled three points where I loaded into size too early because of my infatuation with the trade idea. In anticipation of the break through the previous day’s high of $18.63, my trigger on the trade, I entered into a large short position. In each instance, I was shaken out of my size. I tried the trade so many times that I eventually grew frustrated and shifted my focus elsewhere. About an hour later, the trade happened just the way I had envisioned it. Volume spiked, the $18.63 level was breached, and stock plummeted almost $4 within 20 minutes. If I had been patient, I would have killed that trade and made my day (or even my week!). My biggest mistake was falling too far in love with my idea and trying to be early to the party instead of simply waiting for my trigger price to be breached. There is a reason we have trigger prices as technical traders, because those are the levels when volatility increases, computers take notice, and traders look to initiate positions. The downfall of the stock accelerates as each chaser gets thrown off the bandwagon.

Yesterday I made a mistake. I knew better than to be early to that trade, but I let my emotions get the best of me. My career has been full of mistakes, but nobody is perfect. The reason I continue to make money is that I learn from my mistakes. I allow each failure to make me stronger. In this case, I learned an important lesson that will serve me well going forward. I am not willing to hold losing trades against me (which is why I make money 9 out of 10 days) so I must be precise with my entries and exits. I may not have the best ideas all the time, but when I do come up with one, I make the sure to get the most I can out of it without taking big risks.

“Wherever you go, go with all your heart.” –Confucius