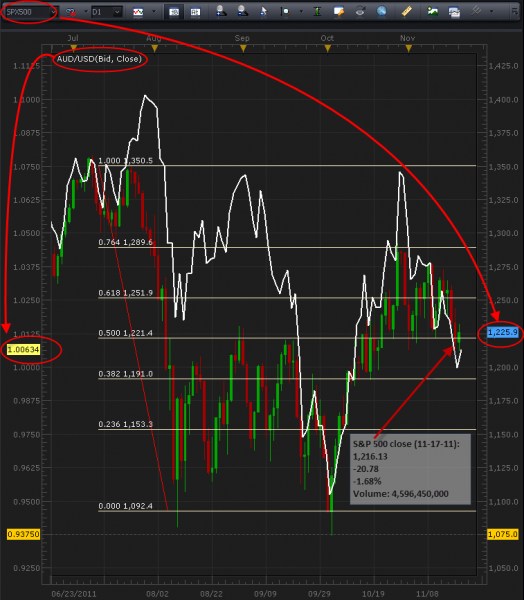

-The SPX 500 looks to open higher as it sits above the major 1,220 level after gaining ground overnight (screenshot 9:25am EST). The month of November has been quite bearish as European bonds soar higher causing a decline in equities as risk off trading increases.

-The commodity currency, AUD/USD has become a closely correlated pair to the SPX 500. If we see the SPX 500 continue to drop towards the 1,200 area, we may expect the AUD/USD to continue its bearish direction below parity. On the other hand, no news out of Europe can be a good thing for equities, this may begin to stall the November declines and hold the AUD/USD above parity.

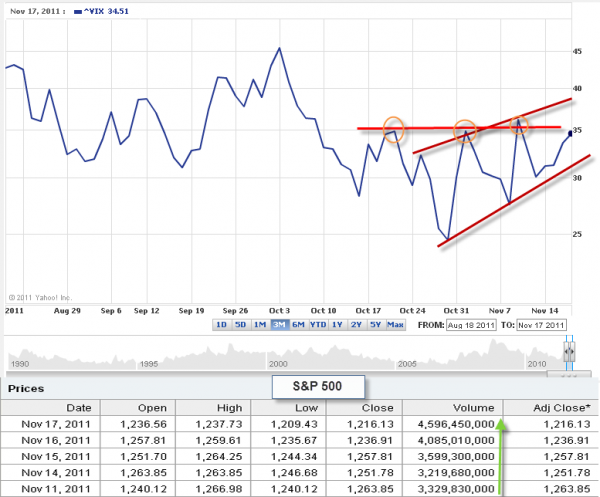

-The VIX has bottomed out at the 25 area for the month of October and now approaching a resistance point at 35 for the third time. If this area is clearly broken we could see additional declines in equities as the USD gains ground. This afternoon we have FOMC member Fisher at 1:15pm EST, use proper risk management as the S&P volume has increased each day this week. Feel free to contact us at info@bbfx.com with any additional questions.