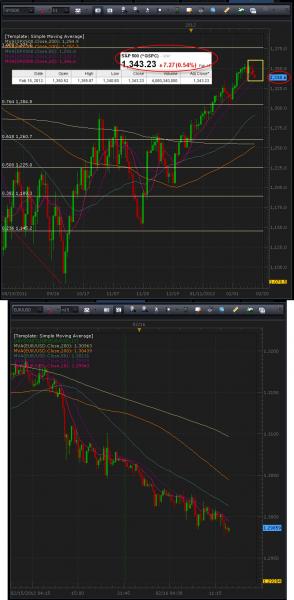

The SPX 500 sits about 5 points lower than yesterday’s close on the S&P 500. The SPX 500 has finally closed below the 10 Day Simple Moving Average as the market begins to consolidate over Greece’s next bailout funds.

It may be best to wait for confirmation if you’re looking for the big reversal because we have a good amount of releases (US Building permits, PPI, and Unemployment claims) at 8:30am EST and Bernanke speaking at 9:00am EST.

Meanwhile the EUR/USD is now sitting below 1.30. If the risk-off trend continues after the US open, we should see the USD appreciate especially against commodity linked pairs (NZD/USD and AUD/USD).

Moody’s has warned to downgrade 17 Global banks heading into a 3-day weekend (February 20th is Presidents’ Day). We will see if they follow through with anything after Fridays close and if it would actually shake the markets.