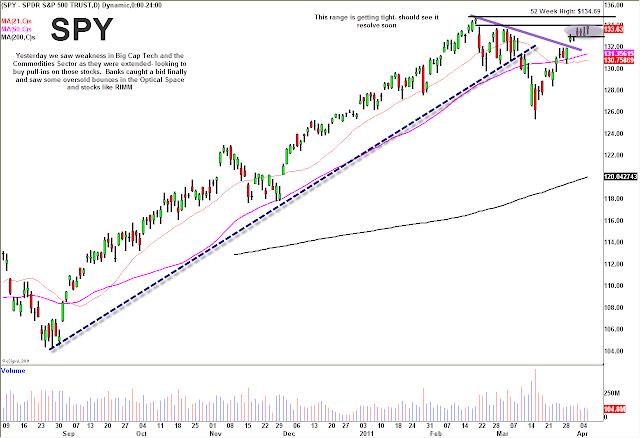

S&P futures are currently slightly lower pre-market as the market continues to stall in front of bigger resistance. Yesterday after opening at the upper end of the current range, the market pulled off, while most of the high-flying stocks from earlier in the week got hit hard. However, the market bounced in the afternoon and leading stocks repaired some of the damage. At this stage, it will be important top see if leading stocks hold their 10-day moving averages, as most of them did yesterday. They could use a few more days of rest before being compelling longs again.

The market sometimes does funny things, and that was the case yesterday as some of the lagging sectors found strength on a day when the tape was weak. Money rotated into to the banks yesterday, it will be nice to see if they can get some follow-through. Leader JP Morgan Chase & Co. (JPM) is the most compelling in the group after breaking out yesterday, but now that there is confirmation of strength in the group you could potentially get some great risk-reward with laggards. Goldman Sachs Group Inc. (GS) is breaking out of its 2011 downtrend, but Wells Fargo & Company (WFC) is perhaps the most compelling out of a month and a half long wedge pattern.

For more market and stock commentary watch the T3Live.com Morning Call with Scott Redler and Alix Steel (below).

As far as the S&P goes, on the micro level it will be important to use 1328-1330 as support. If this level breaks, the upside will lose some momentum. Under that area is a very important support at 1318-1322. A test of this level can happen and still be constructive, but it must hold. Resistance stands still at 1332-1335 then the old highs of 1343. Although we have been indecisive in this range, it still feels like we want to resolve this range to the upside.

Tech led this market bounce, and then was among the high-flying groups that got pegged back yesterday. Perennial group leaders are looking a bit sickly when you talk about Apple Inc. (AAPL) and Google Inc. (GOOG). AAPL continues to be weighed down by Steve Jobs uncertainty and was also hit during index rebalancing Tuesday, but remains very undervalued. Those with a long-term perspective can buy Apple and put it in a drawer, active traders might want to wait for a more compelling chart pattern. GOOG is being hampered by anti-trust investigation both in Europe and at home, where regulators are taking a look at the company’s control of the search market.

After yesterday’s big pull-in in leading momentum stocks, it’s time to take a look at specific names to see whether they are buyable here. Chinese stocks led the market bounce, and they look best for dip buying opportunities here. Baidu.com, Inc. (BIDU) is one of those candidates after a monster move from our $125-126 macro buy. It got hit yesterday. and Scott Redler says he will look to buy back around $132-134. SINA Corporation (SINA) needs some time perhaps, but also feels like it has more in the tank once it gathers itself. Same story with Sohu.com, Inc. (SOHU), which Redler says he may look to add back at the $90 area.

Yesterday we highlighted the oil service sector as an area that could see some money rotate in after other groups broke out from upper level consolidations. However, the Oil Service HOLDRs ETF (OIH) and its component stocks had a tough day as the market pulled in. The ETF resolved the upper level base to the downside, and unless it can get a quick bounce back into that range, it will need more time to re set-up.

Casinos are acting a bit better, as the clear-cut hierarchy remains. Wynn Resorts Limited (WYNN) is still the clear cut leader, and is another one of the those leading stocks that could be buyable here on the pull-back if the market can break above the consolidation area. Las Vegas Sands Corp. (LVS) is lagging badly over the past few months, but has provided some nice juice for traders looking for an oversold bounce. The $46-47 level is the next area of resistance for LVS.

In the apparel space, high fliers Lululemon Athletica, inc. (LULU) and Under Armour, Inc. (UA) also pulled in hard yesterday after a period of sustained, resilient strength. Just like all of the other momentum leaders that pulled in, an aggressive trader might be buying some here and adding lower if need be. Retail wholesalers are a group that haven’t broken out yet and have solid chart patterns. BJ’s Wholesale Club, Inc. (BJ) above $50 can be good for a breakout trade, as can Costco Wholesale Corporation (COST) above $76.

Finally, precious metals were the big story Tuesday as they blasted off to new highs. Strongest in that space were the gold miners which handily outperformed the underlying commodity, a rare occasion. The SPDR Gold Trust ETF (GLD) and the Market Vectors Gold Miners ETF (GDX) still looks good for higher prices, but may need some time to digest before getting there. Redler is in light gold and will look to add on weakness down to the breakout level.

*DISCLOSURE: Scott is long AAPL, MGM, LVS, JPM, WFC, GLD, BAC, F, LEI, V, NG, XOM, JCP, AXP, LMT, ABX, FCX, RBY, AUY, ROYL, MSFT, JDSU. Short SPY, VHC.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.